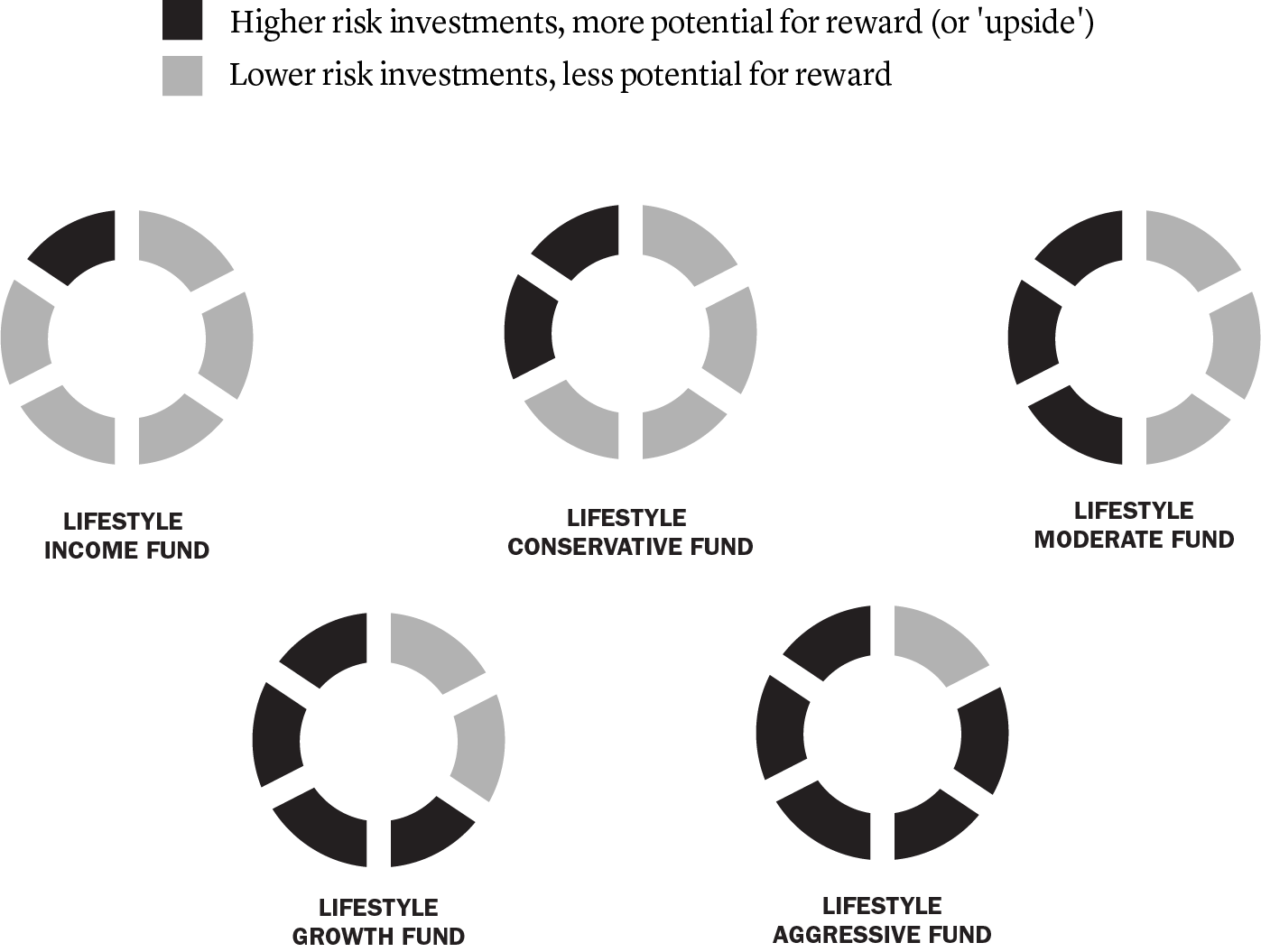

1 Lifestyle funds are subject to include asset allocation risk, active management risk and underlying fund risk. These funds are also subject to the risks of the underlying funds in which the fund invests in. This may include equity investment risk and fixed income investment risks. Be sure to reassess goals regularly and if your situation has changed, you may want to choose another lifestyle fund that more closely matches your new risk profile.

2 Source: Morningstar Direct as of June 30, 2022; Institutional share class.

3 Source: Morningstar Direct. Latest data run on July 7, 2022. Categories are within the US Fund Universe (includes Open-End Funds and ETFs).

TIAA products may be subject to market and other risk factors. See the applicable product literature for details.

This material is for informational or educational purposes only and does not constitute fiduciary investment advice under ERISA, a securities recommendation under all securities laws, or an insurance product recommendation under state insurance laws or regulations. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor’s own objectives and circumstances.