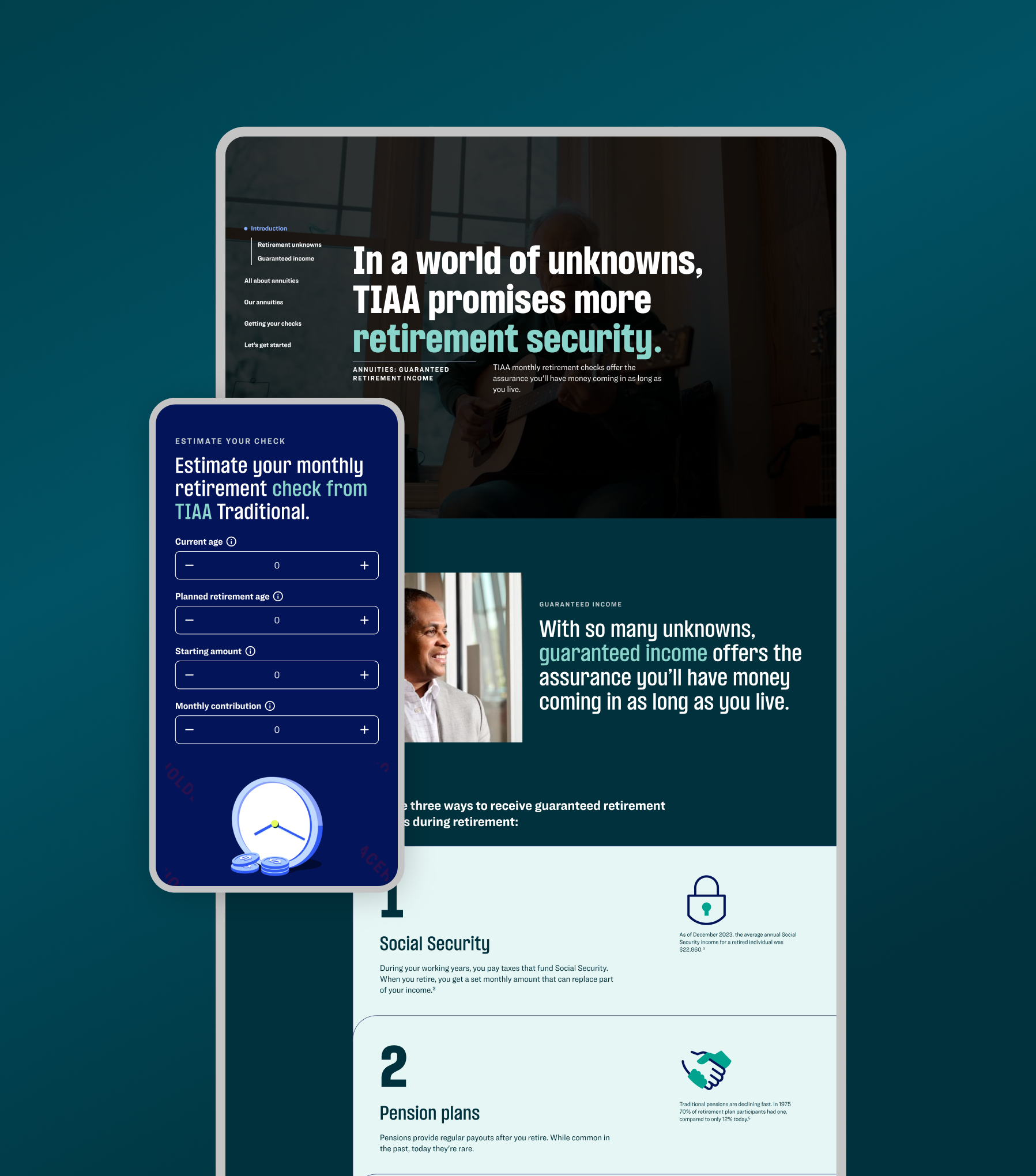

Lifetime income

Money coming in for as long as you live.

That's the power of a TIAA retirement annuity. We've created a way to learn about lifetime income so you can achieve the retirement security you deserve.

Personalized advice

Receive custom insights to help optimize your investment portfolio using our Retirement Journey Planner.

Enroll in your plan

Learn about your plan, set up your account online and start saving for retirement right now.

Our vision

Since 1918, we’ve championed a singular belief: A secure retirement should be available to everyone. Today, we’re fighting harder than ever to ensure all people can live a better life beyond work.

Why TIAA

Count on us for a more secure retirement

Guaranteed growth and income

With the TIAA Traditional annuity, your money grows—no matter what. When you retire, you can convert those savings into a guaranteed monthly retirement paycheck.

Professional support

Whether you need a little help or a lot—in person, on the phone, or online—we’re here to help you achieve your goals before and throughout retirement.

Responsible investing

Our legacy of responsible investing spans half a century. We continue to build out our environmental, social and governance principles, practices and impacts across our $1.2 trillion in assets under management (AUM).

Performance

To earn your trust, we focus on delivering results

Our funds are backed by our storied history of investing and money management expertise.

$1.4T

We are one of the largest investment managers with $1.4 trillion in assets under management.2

$3B

In just the last three years, TIAA has shared $3 billion annually with more than 2 million fixed annuity customers. Because when we perform well, our customers do better.3

4.7M

Nearly 5 million individual customers across America are building their retirements with TIAA.4

125

Through the power of TIAA and Nuveen, our team delivers more than a century of experience managing assets designed for income—uniquely equipping us to realize financially secure retirements.

Our latest thinking

Financial essentials

Market volatility and your journey to retirement

Get tips from TIAA on how to handle unsettled markets.

Wealth management

Making sense of recent market volatility

Professional portfolio management can assist when it comes to navigating market volatility, and can help investors stay on track to reaching their long-term financial goals. Read more from our Wealth CIO on what’s driving recent market volatility and key considerations for your financial plan.

Financial essentials

Taking advantage of your retirement advice benefit

TIAA retirement plan participants have free access to our team of financial consultants as well as our digital planning experience to help you create a plan that takes into account your specific needs.

1. Retirement paycheck refers to the annuity income received in retirement. Guarantees are subject to TIAA's claims-paying ability.

2. TIAA and Nuveen assets under management as of 12/31/2024 are $1,378B or $1.4T.

3. TIAA may share profits with TIAA Traditional annuity owners through declared additional amounts of interest during accumulation, higher initial annuity income, and through further increases in annuity income benefits during retirement. These additional amounts are not guaranteed beyond the period for which they were declared. TIAA Annual Statement (2013 -2022), Page 4, Line 30.

4. As of June 30, 2023