What is a Health Savings Account (HSA)?

The TIAA HSA administered by HealthEquity is a tax-advantaged savings account designed to cover healthcare expenses today, tomorrow or in retirement. The TIAA HSA is open to those participating in a high deductible health plan (HDHP). And it integrates online with TIAA accounts you may already have.

Want to talk? Call our TIAA HSA administrator HealthEquity at

Take control of your healthcare expenses

The TIAA Health Savings Account (HSA) may help raise your financial confidence by giving you more control of how to pay and save for healthcare expenses. The investment potential of an HSA also gives you the option to help grow savings for the future. Benefits include:

Qualified medical expenses1

A HSA can be used tax-free to cover:

- Insurance deductibles

- Qualified healthcare expenses that insurance plans might exclude

- Co-payments and coinsurance until you reach your health plan's out-of-pocket maximum

- Qualified medical, vision or dental expenses that may not be covered by your HDHP.

How an HSA works

- Contributions to the HSA are tax-free for you—whether they come from you or your employer

- Your account and investment earnings potentially grow tax-free

- You can withdraw your money tax-free at any time, as long as you use it for qualified medical expenses

Invest your money

You decide how to use the HSA money, including whether to spend it now or save it to cover medical expenses in retirement (subject to minimum balance requirements). As your balance rolls over from year to year ("use it or lose it" does not apply), it earns interest, and you can invest in selected mutual funds much like with a Retirement account.

Who is eligible for the TIAA HSA?

If you are participating in an HDHP2 through your employer, you may be able to direct your HSA contributions to the TIAA HSA3. Check with your employer to see if they offer the TIAA HSA or if they let you choose where to direct your HSA contributions.

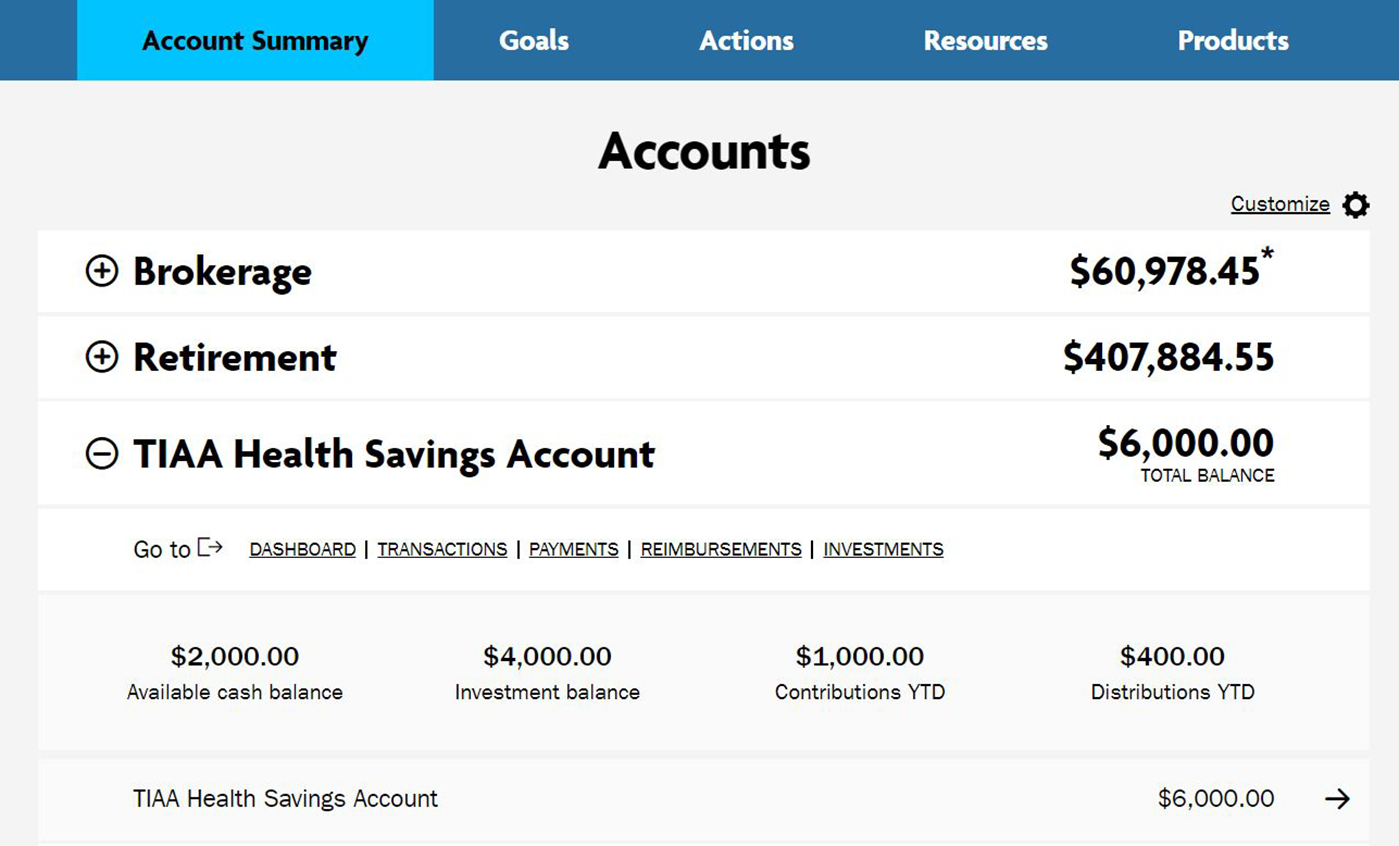

If you already have an HSA, you can transfer the balance to a TIAA HSA. This will enable you to consolidate your assets and see all your TIAA retirement, HSA and other TIAA account information with one login, on both a desktop web page.

Or call our TIAA HSA administrator HealthEquity at

Benefits now. Benefits tomorrow.

An HSA is a triple tax advantaged savings account to cover medical expenses today, tomorrow or in retirement. See how the tax advantages can benefit you now and in the future.

HSA tax advantages

Use this simple tool to see an estimate of how your tax savings could add up over time. Get ready for a big wow.

Get set up in as little as 10 minutes

Our HSA administrator HealthEquity makes enrollment easy and quick.

1 QMEs are designated by the IRS. See

2 A qualified high deductible health plan (HDHP) is a type of health insurance plan that offers higher annual deductibles (as defined by the IRS) but with lower premiums than traditional insurance plans. HDHPs offer preventative care with no out-of-pocket costs and set annual out-of-pocket maximums, which provide protection from large healthcare expenses. Using an HDHP with a health savings account (HSA) can be a financially effective way to help you meet your healthcare needs.

3 The IRS has strict guidelines to determine who is eligible to own and contribute to an HSA. Under current law, to be eligible to contribute to an HSA, an individual:

- Must be covered solely by an HSA-qualified health plan or HDHP. It is the HSA account holder's responsibility to make sure that they are not covered under any other plans that don't meet the IRS rules for HDHPs. This includes coverage through a spouse (including the spouse's FSA and Medicare). Other health coverage including Medicare and traditional health plans may also disqualify an individual.

- Cannot have a full-purpose FSA (including through a spouse). However, individuals can have a limited-purpose FSA to pay for dental and vision expenses.

- May not be claimed as a dependent on another individual's tax return.

The TIAA Health Savings Account is administered by HealthEquity, Inc. TIAA and HealthEquity are not legally affiliated.

HealthEquity nor The TIAA group of companies does not provide tax or legal advice. Taxpayers should seek advice based on their own particular circumstances from an independent tax advisor.

Health savings accounts (HSAs) are individual custodial accounts offered or administered by HealthEquity, Inc. TIAA and HealthEquity are not legally affiliated, and HSAs are not a plan established or maintained by TIAA or an employer. TIAA may receive a referral fee based upon the type and number of accounts opened at HealthEquity.