April marks Niladri “Neel” Mukherjee’s one-year anniversary as chief investment officer of TIAA Wealth Management. To celebrate the milestone, Mukherjee has been crisscrossing the country, meeting with over 200 TIAA wealth clients at a half dozen company events.

His biggest takeaway from all these conversations?

“Everyone is wondering and worrying about the same things,” Mukherjee writes in the April editionOpens pdf of the CIO Perspectives newsletter. “The rocket scientist in Pasadena asked me virtually the same question about artificial intelligence (AI) as the law professor in Washington, D.C.”

Six questions came up repeatedly, and Mukherjee does a deep dive into all of them in this month’s CIO Perspectives. You can read the full report hereOpens pdf. A summary of his answers to the three most-asked questions follows below:

Q: How will the economy impact the election?

Inflation continues to be top of mind for American voters, Mukherjee says. Historically, U.S. politics and inflation have been linked, with inflation causing major headaches for incumbent presidents. While inflation has slowed over the past 18 months—from 9% in mid-2022 to 3% by year-end 2023—prices are still up 20% overall since early 2020. The increase is more pronounced for groceries (+25%) and vehicles (+22%).

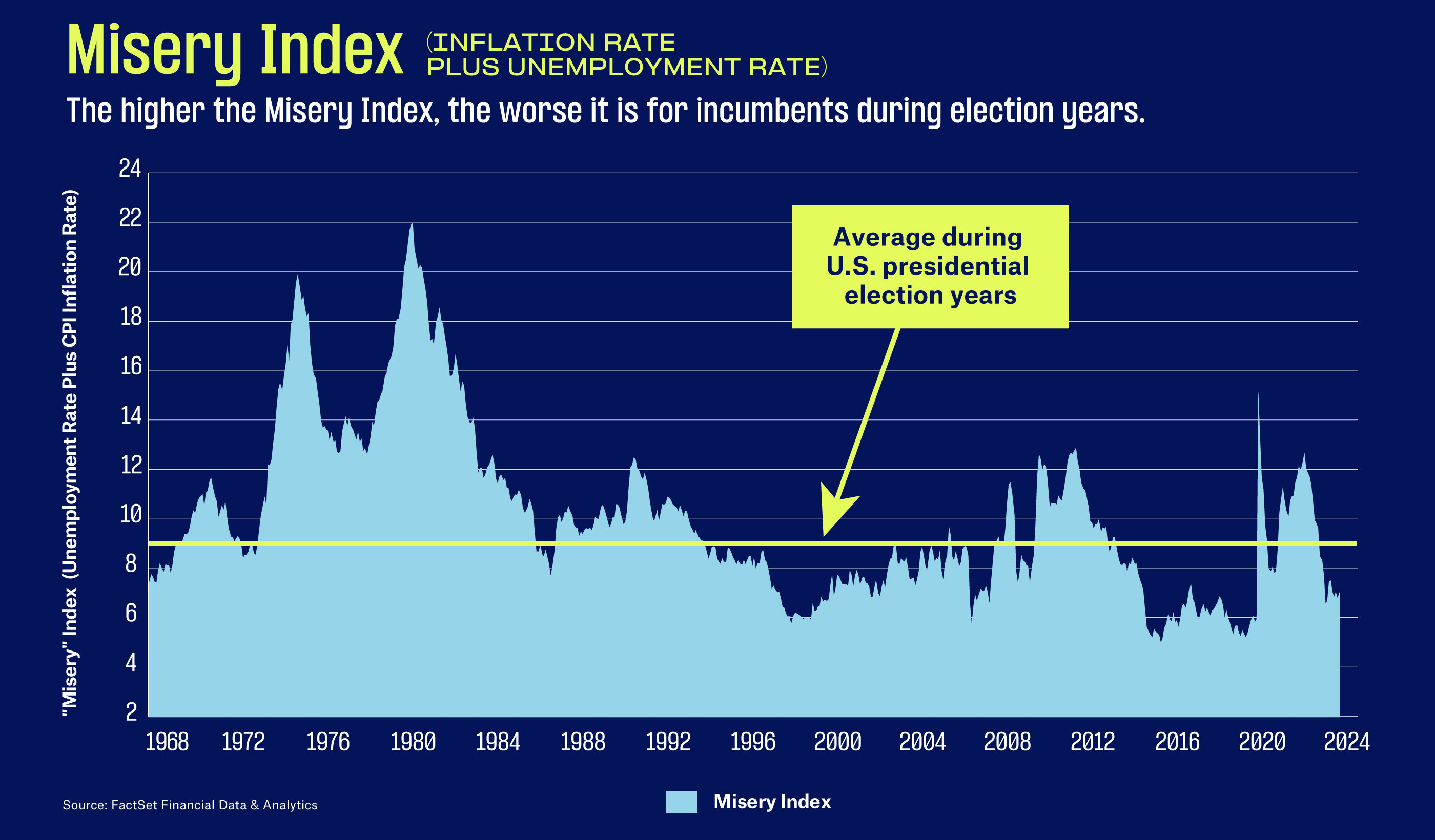

The so-called Misery Index (inflation rate plus unemployment rate) has been a reliable gauge of voter attitudes toward the economy. The higher the Misery Index, the worse it tends to be for incumbents. Since 1960, the average reading of the Misery Index in January of presidential election years has been 9. In the years the incumbent party ultimately lost the White House (1960, 1968, 1976, 1980, 1992, 2000, 2008, 2016, 2020), the January Misery Index averaged 10—or slightly above average. In January 2024, the Misery Index stood at 7, which was below the average reading when the incumbents lost and well below the four-decade high of 15 during the pandemic.

The current Misery Index reading would suggest an advantage for President Biden in 2024 (see chart).