A sea change in international relations

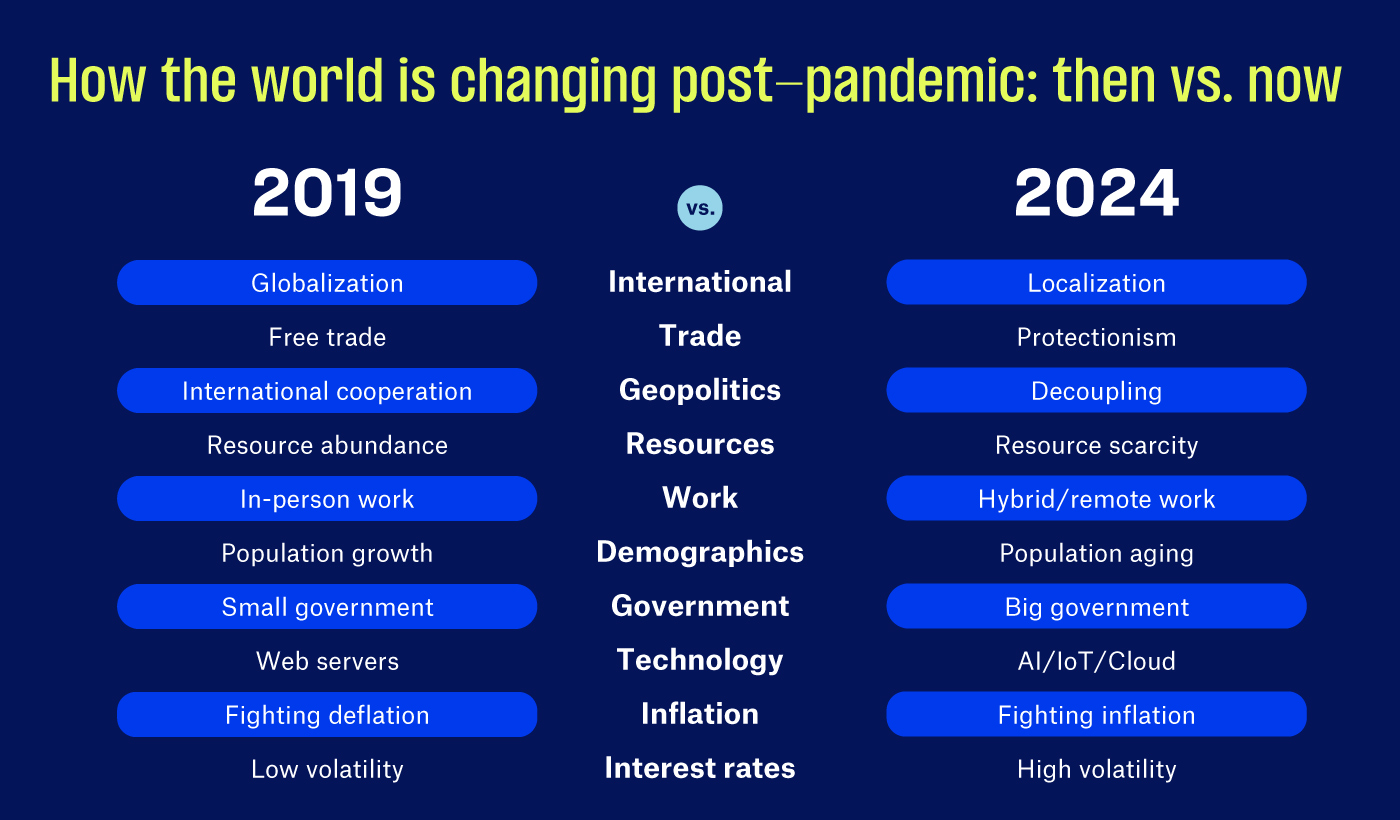

Covid’s most direct impact on international relations was the disruption of trade routes and supply chains. The cost of shipping goods from the port of Shanghai to the port of Los Angeles, for example, spiked to $12,000 per 40-foot box in 2021 from an average of $1,700 between 2010 and 2019. The busiest ports around the world experienced snowballing backlogs as lockdowns disrupted trade operations. This pressure on supply chains wound up accelerating shifts from offshoring to onshoring, from globalization to localization—shifts that had started during the Trump administration.

Tariffs were imposed to onshoring and localization, as countries prioritized jobs and national security over free trade. In the run-up to the U.S. presidential election in November, trade remains a prominent issue for both Republicans and Democrats. Former President Trump has promised a blanket 10% tariff on all U.S. imports and a 60% tariff on all Chinese goods. President Biden supports tariffs on key imports from China and recently announced the quadrupling of existing tariffs on electric vehicles. This points to escalating trade tensions across the globe—a byproduct of the supply chain chaos caused by the pandemic.

Technology

Major scientific and technological advancements have often been born out of crisis. World War II, for example, spurred the development—and later the mass commercialization—of technologies first intended as tools of war. The cavity magnetron, a technology used to improve the accuracy of radar, was put to work after the war to develop the microwave oven, for instance. Devastating injuries on the battlefield led to the mass deployment and production of life-saving antibiotics like penicillin.

Much like penicillin—which was discovered by Alexander Fleming in 1928 but not commercialized until after WWII—synthetic mRNA had been under development for decades before Moderna and Pfizer used it to produce the first Covid vaccines. By leveraging and improving the existing technology, scientists working on Covid vaccines were able to move from pre-clinical stage to emergency approval in less than a year—and to full approval stage in just 18 months (compared to the normal timeline that could stretch to as many as 10 years).1 A global crisis led to a scientific breakthrough that now holds the promise of an expanded drug pipeline that could address some of the deadliest and most common diseases.

Labor shortages caused by the Covid crisis also accelerated development and adoption of artificial intelligence (AI). A study by PwC2 found that 52% of surveyed companies accelerated their AI strategy in 2020, and since then, a little-known start-up called OpenAI launched ChatGPT, a chatbot based on large language models that represent the first step towards mass adoption. As uses for AI become more visible, there’s been increased corporate investment in AI services and infrastructure. While the ultimate return on investment is uncertain, these companies appear well positioned to participate in the long-term growth of AI.

Market implications

Even as daily life returns to normal, the legacy of the pandemic is everywhere in the global economy. Increased fiscal stimulus, an upsurge in protectionism, the fracturing of international relationships and generational advancements in technology are all direct or indirect byproducts of the pandemic. So too are higher interest rates and stubborn inflation. For all these reasons, the pandemic continues to shape our market outlook, even as lockdowns and mask mandates fade from memory. In the equity market, investment opportunities should multiply as more companies use AI to enhance profitability. In the bond market, massive fiscal stimulus and soaring budget deficits inform our “higher for longer” position on interest rates—and on when the Fed might start cutting.

Click hereOpens pdf to read the full version of June’s CIO Perspectives. For more insights on the market and economy, and to discuss the implications for your investment portfolio and financial plan, please schedule a meetingOpens in a new window with a TIAA advisor.