At a recent TIAA client event, a retiree asked TIAA Wealth Management Chief Investment Officer Niladri Mukherjee whether he should consider adding cryptocurrencies to his portfolio. Mukherjee replied that while he and his TIAA team are intrigued by the long-term business potential of blockchain (the digital bookkeeping system used to track crypto transactions), they are not recommending cryptocurrencies to clients at this time.

Given crypto’s stellar performance so far in 2024—Bitcoin is up nearly 50% year to date,1 and several new crypto-focused exchange traded funds (ETFs) have climbed even higher2—now seems like a good time to reexamine why TIAA has not hopped on the crypto bandwagon.

TIAA’s stance on crypto boils down to recognizing the difference between speculation and investing, says John Canally, TIAA Wealth Management’s chief portfolio strategist. Generally speaking, speculators buy and sell assets with the goal of profiting off short-term price movements. Investors, on the other hand, seek income and long-term gains by accepting financial risks that are knowable and understandable. TIAA considers crypto a speculative asset, not one with knowable or understandable risks.

If TIAA portfolio managers invest in a publicly traded stock with no debt and $20 billion in net cash on its balance sheet, they’ll know with a high degree of certainty that the company’s stock market capitalization is unlikely to fall below $20 billion. If they invest in U.S. Treasury bonds, they’ll know that the federal government has been making good on its interest payments to bondholders for over 200 years. If they invest in a real estate investment trust that owns farmland, they’ll know the supply of arable land in the U.S. and the world.

“There might be some very short-term risk you don’t understand—Covid, for example,” says Canally. “But over the long swath of history, most of the risks associated with investing in stocks and bonds are knowable.”

In contrast to the traditional asset classes, crypto has no balance sheet to consult, no established track record of interest payments to fall back on, and no way of measuring the supply part of the supply-and-demand equation. “I couldn’t tell you what the supply is for crypto,” says Canally. “Technically it’s unlimited.” TIAA’s investment team wrote in a note to clientsOpens pdf earlier this year that “there is no established or intrinsic value for cryptocurrencies. They’re worth what people believe they’re worth on any given day.”

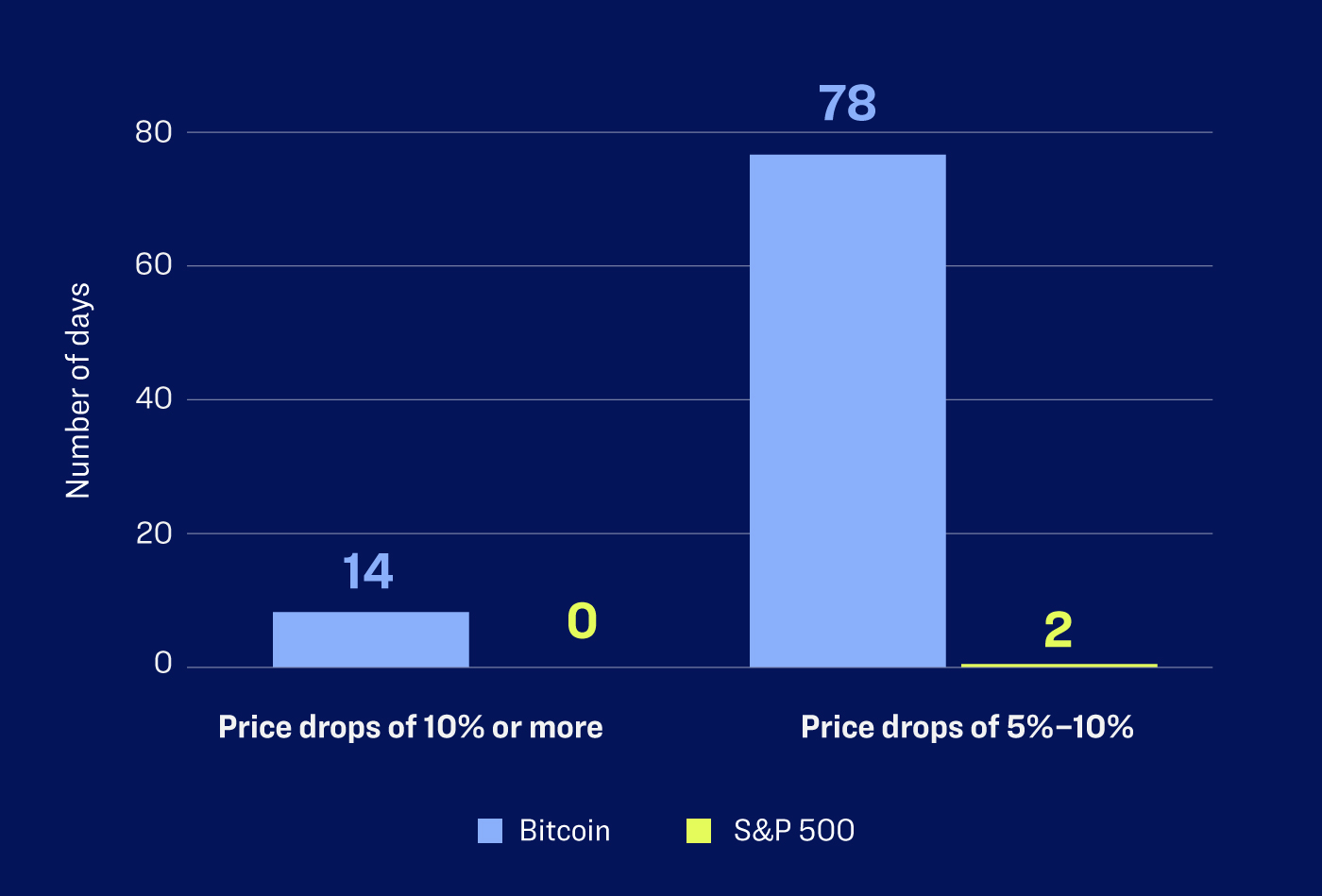

This uncertainty over how to value crypto has led to extreme price volatility. Over the past five years, Bitcoin has experienced 14 one-day price drops of 10% or more and another 78 declines of between 5% and 9.9%.3 To put this into context, the S&P 500 equity index over the same time period experienced zero one-day declines of 10% or more and only two declines of between 5% and 9.9%.4 (The S&P’s biggest one-day loss over the past five years was 5.7% on March 12, 2020.)