Key Takeaways

- Investors are hoarding more cash than ever, the Federal Reserve reports.

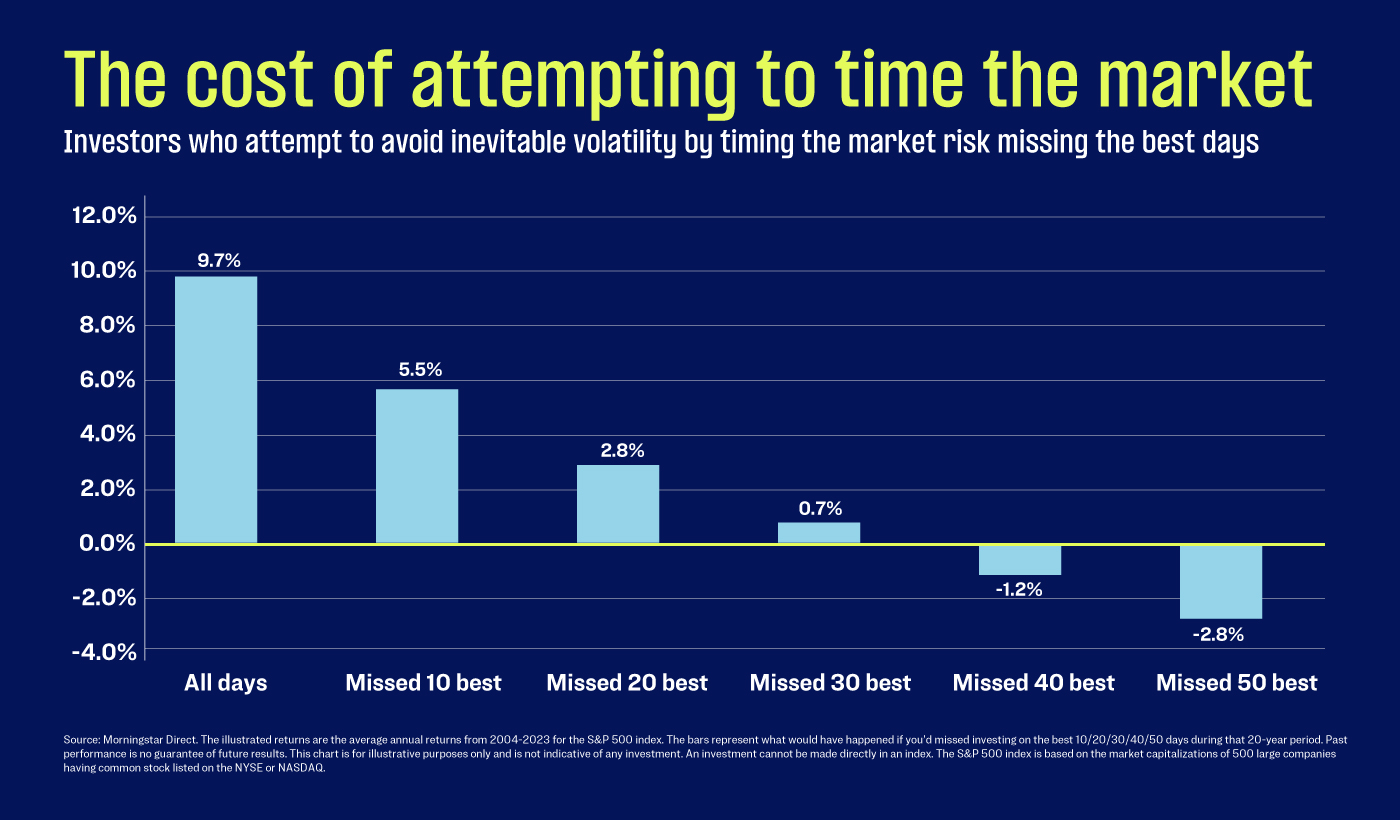

- Attempting to time the market is fraught with pitfalls; missing just a few of the best days can significantly dent your return.

- If your asset allocation is too cash heavy, talk to your TIAA wealth advisor about reinvestment strategies.

The doctor had timed the market perfectly. Or so it seemed.

It was December 2021, and he decided to move a big chunk of his stock portfolio into cash. The Standard & Poor’s 500 had just shrugged off the pandemic, inflation and supply-chain disruptions to end the year with a whopping 28% total return. Equities had become much too expensive, the doctor told his wealth advisor.

His advisor warned him that trying to time the market was risky, but the doctor was adamant. And for a while, his gambit looked prescient. The S&P 500 fell 18% in 2022, and the bond market suffered double-digit losses too. Unfortunately, his prescience proved short-lived. “He’s still sitting on that cash,” Jeffrey Mellone, a TIAA executive wealth management advisor, says of his client. “He was in cash all of 2023. We’re now four months into 2024, and he’s still reluctant to get back in.”

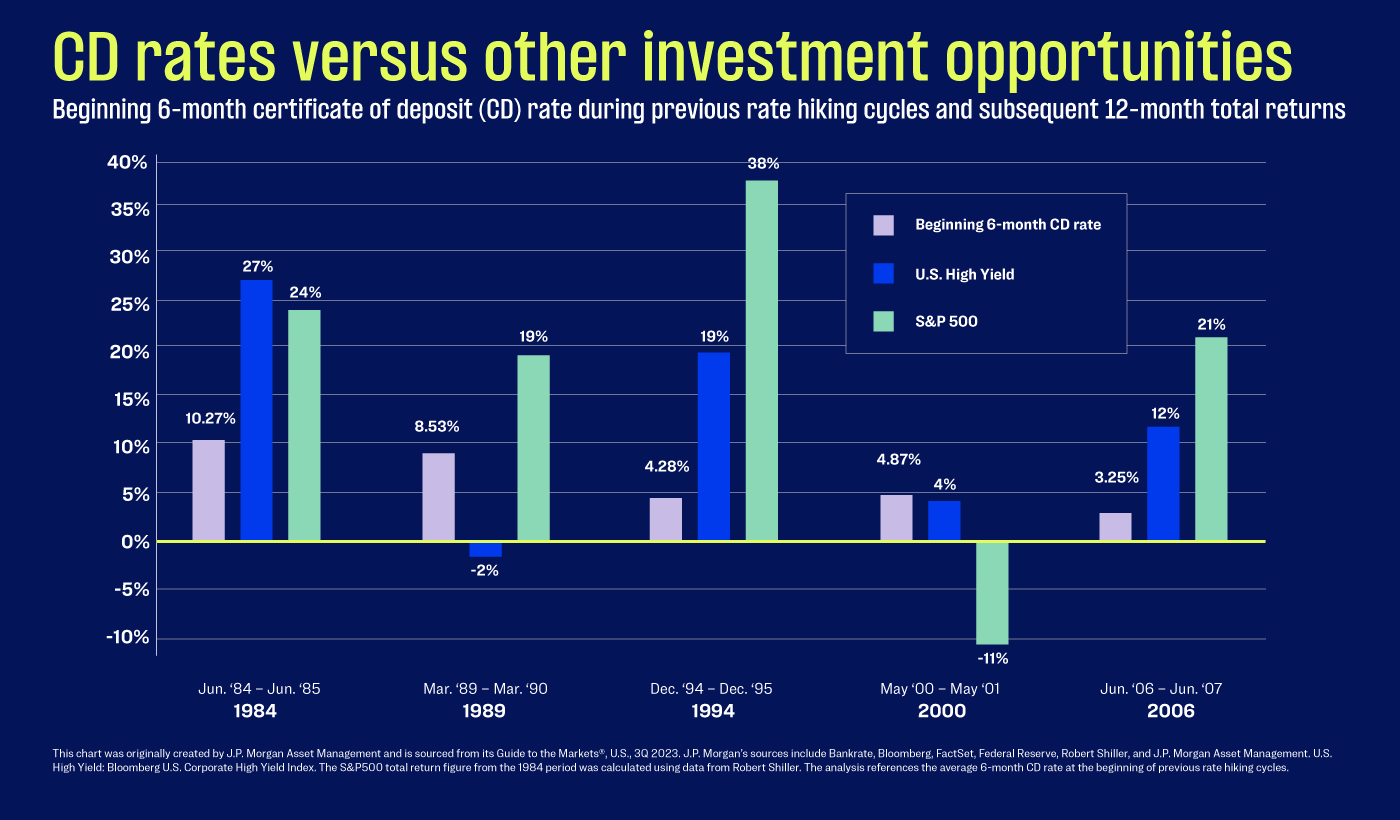

To be fair, the doctor has plenty of company, as the lingering effects of 2022 still have many investors spooked. According to the Federal Reserve Bank of St. Louis, money market fund assets now sit at historic highs, increasing from $5.2 trillion in 2022 to $6.4 trillion in 2023.1 Bank certificate of deposits (CDs) have surged too.2

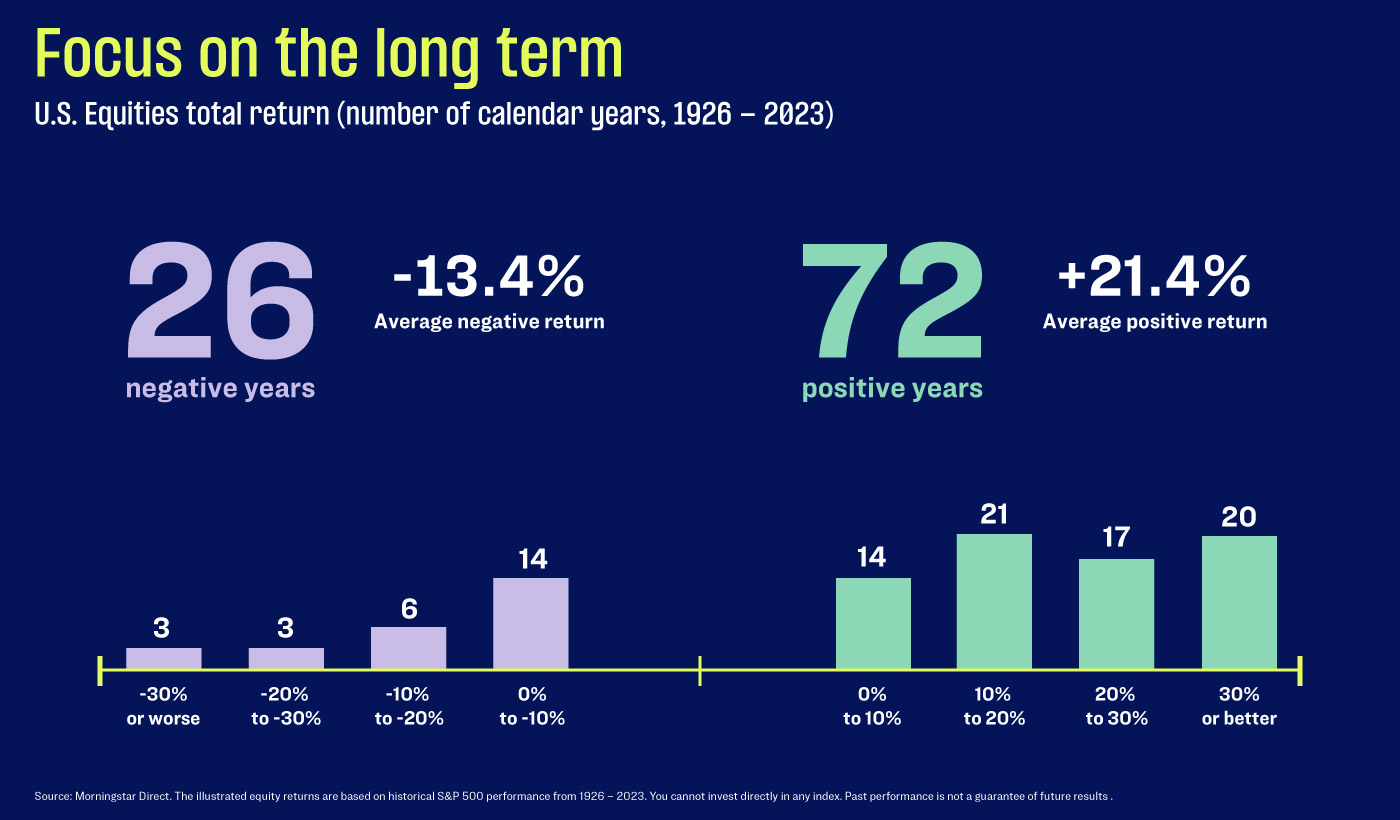

Stories like the doctor’s frustrate TIAA Chief Portfolio Strategist John Canally to no end. The doctor may have avoided a 18% loss in 2022 by getting out of stocks at the right time, but he missed out on a 26% gain in 2023 and another 5% so far in 2024 (through April 18).