Key Takeaways

- Inheritances often come with complicated decisions involving investments, taxes and arranging eldercare. Decisions become easier if your financial advisor already knows your heirs, healthcare proxy and power of attorney.

- TIAA Wealth Management’s “householding” program allows your adult children to work with your wealth management advisor and have access to the same TIAA products and services.

Summer. It’s the perfect time for building sandcastles on the beach, for taking the boat out on the lake—and for something decidedly less fun but no less valuable: introducing your adult children to your financial advisor.

Melody Evans, a TIAA vice president wealth management advisor based in Portsmouth, N.H., urges clients to arrange such meetings now so they can avert a situation in which the first time she meets the next generation is at a time of crisis. “When it comes to dealing with incapacity planning or inheritances, having your children get to know your financial advisor now ultimately makes things much easier in the future,” says Evans. Plus, should your children choose to work with your TIAA financial advisor, they will have access to financial planning products and services that they might not qualify for on their own (more on that in a moment).

Evans prefers scheduling these get-to-know-you meetings in the summer because it tends to be a more relaxed time for adult children with young families. “Summer tends to be a little less chaotic with kids’ schedules,” she says. “Young parents might be a little more open to such meeting now than they would other times of year.”

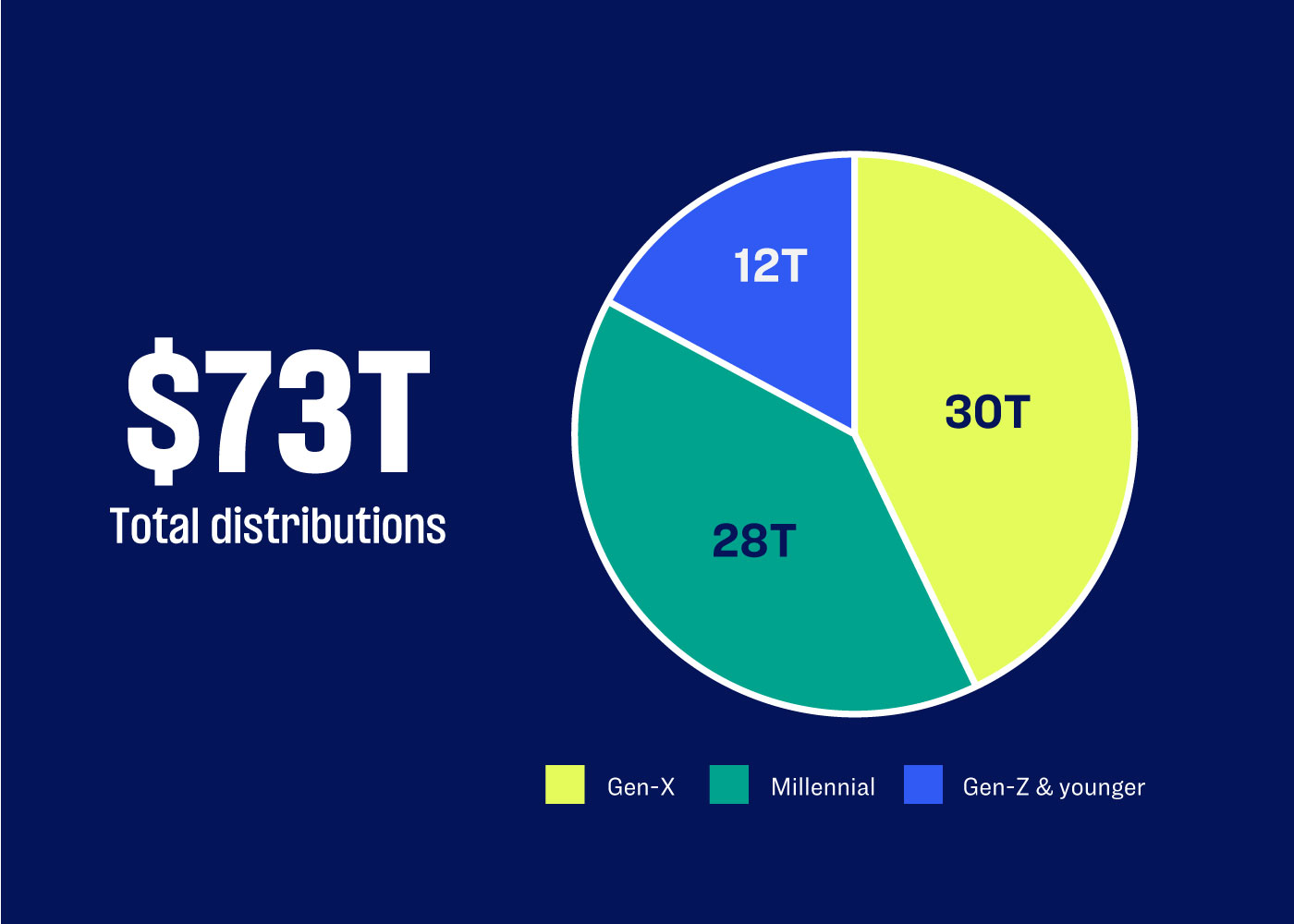

Regardless of when the introductions happen, it’s important they take place. With baby boomers shifting into retirement and beyond, the United States is now on the verge of the greatest generational wealth transfer in history. According to financial intelligence firm Cerulli Associates, boomers and members of the Silent Generation are expected to transfer $73 trillion to their heirs by 2045, with most of that money going to children and grandchildren.1

“Wealth transfer requires generational planning,” says Surya Kolluri, head of the TIAA Institute. “It’s why it’s important for adult children to have a handle on their parents’ finances, even if it’ll be another 10 or 20 years before inheritances and financial caregiving become pertinent.”