Does the expectation of employer-provided health insurance in retirement encourage faculty members to retire earlier and save less than faculty who do not expect to receive this benefit?

Summary

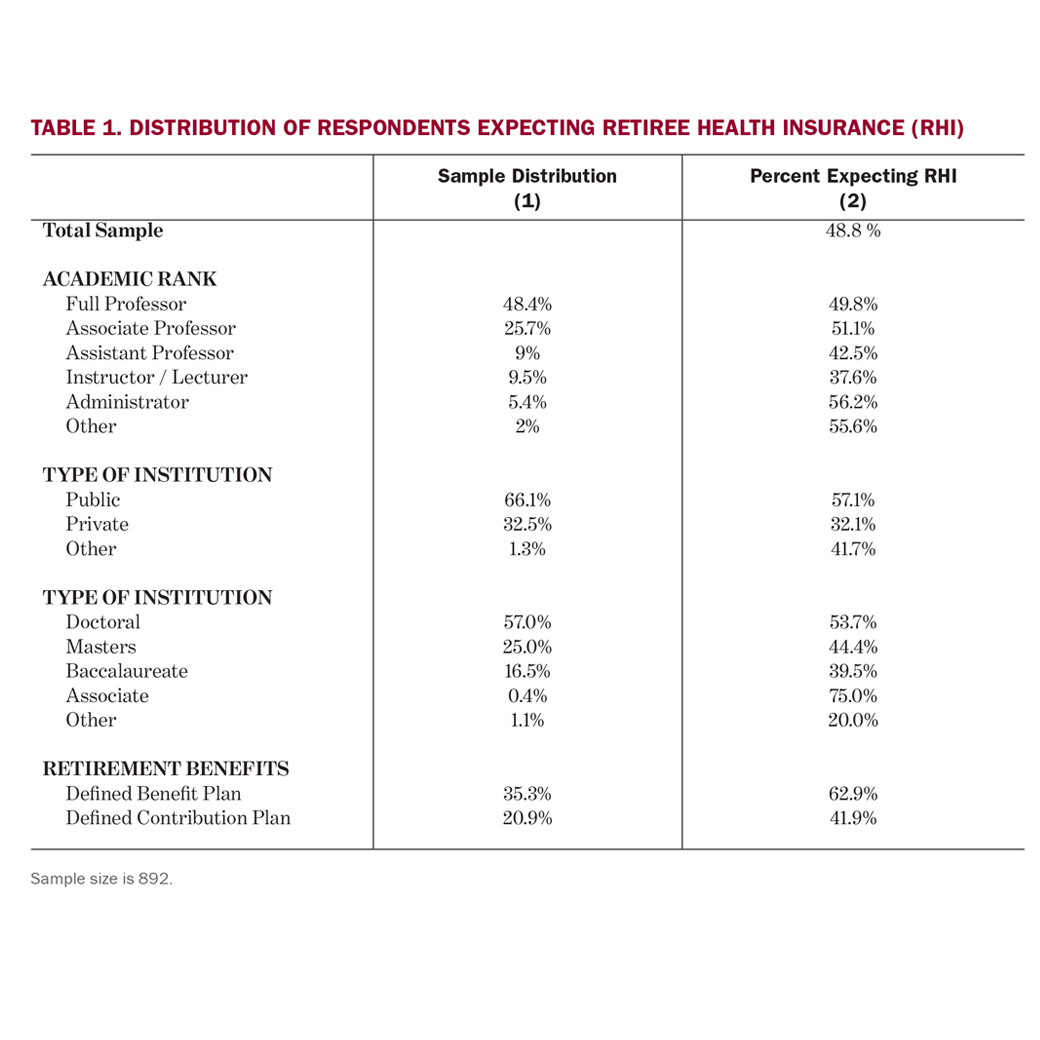

Many public institutions are reviewing their retiree health plans due to increasing annual costs and unfunded liabilities. Academic administrators, however, are cognizant of potential impacts on faculty retirement patterns, particularly the age at which faculty retire. This study, based on a survey of U.S. faculty members age 50 and older, examines how the expectation of employer-provided retiree health insurance affects faculty retirement savings and expected retirement age.

Key Insights

- Employer-sponsored retiree health insurance does not actually induce faculty to retire at younger ages. This result is likely explained by the fact that most faculty work to age 65, and beyond, for nonfinancial reasons.

- Faculty members who receive subsidized health insurance in retirement need to save less while working to amass enough wealth to maintain their desired standard of living in retirement.

- A common way to save while working is through tax-advantaged retirement saving plans. Given the value of retiree health insurance, workers covered by such insurance would be expected to have lower levels of wealth accumulation.

- The study showed more than 50% of respondents with retirement plan balances below $750,000 expect to receive health insurance from their current institution at retirement; only about 25% of those with balances above that amount expect such insurance.