Gen Z—those born after 1996—make up 20% of the U.S. population, and they’re the most educated and diverse generation to date. How do they view retirement?

Summary

Gen Zers are about to surpass baby boomers in the U.S. workforce, so their financial practices and priorities can have a major impact on the economy. This report explores how Gen Zers engage with their finances, what they’re saving for, and how they view retirement at the outset of their careers. The findings shed light on this contradictory generation, one that is both earning and saving more than previous generations but also facing major challenges in building wealth.

Key Insights

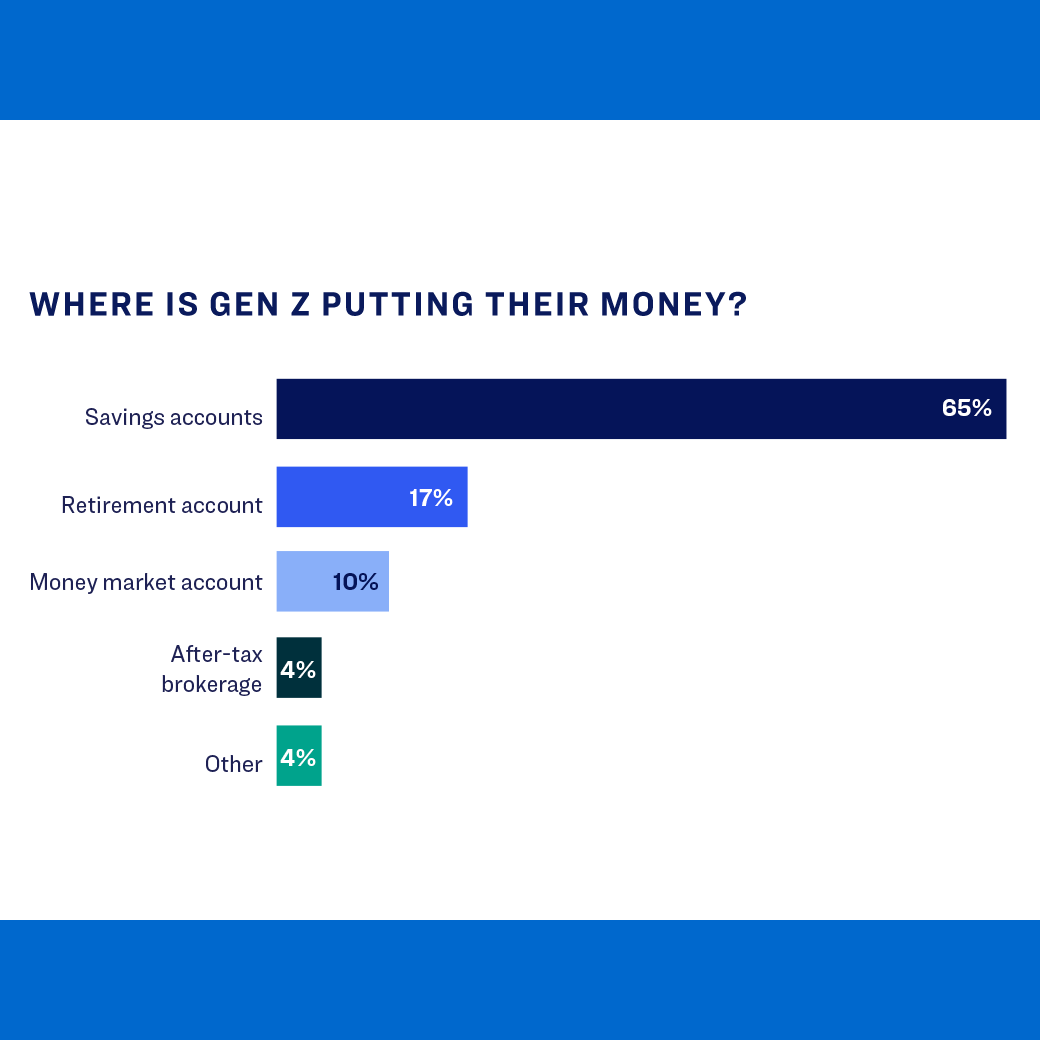

- Over half of Gen Zers use only savings accounts to store their money. For those not investing their savings, the largest portion (35%) say it’s because they “lack knowledge on where to start.”

- Two thirds of Gen Zers who are saving for retirement use 401(k)s, but only one in five are setting aside any money at all for retirement.

- Parents are the main source of financial insight for 61% of Gen Z—but this reliance on parents could perpetuate existing knowledge gaps.

- When asked what they’re saving for most, 19% of Gen Zers said travel, followed closely by building up savings for living expenses like transportation (18%) and housing (17%).