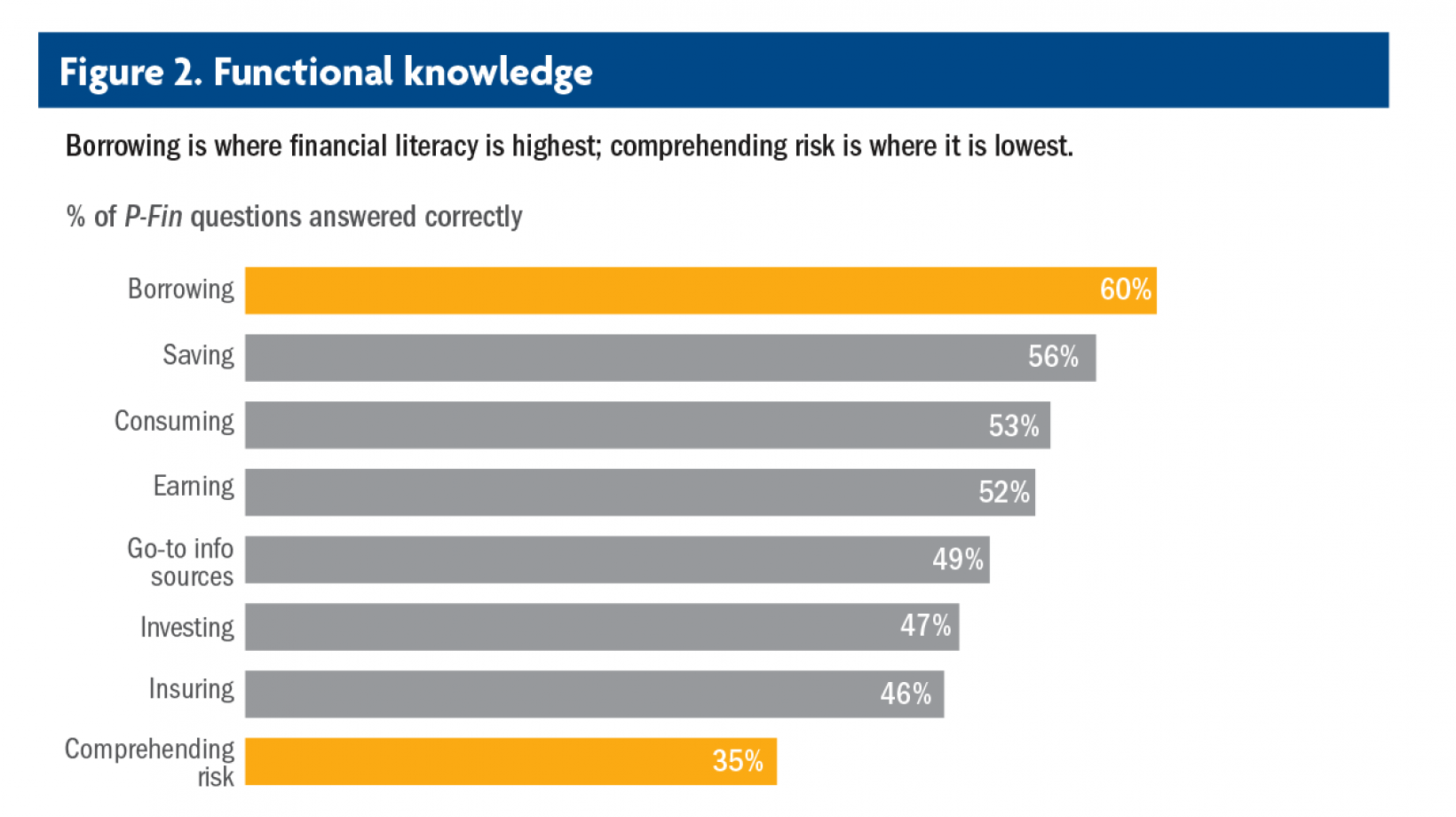

Comprehending risk is the functional area where financial literacy tends to be lowest. On average, survey participants answered only 35% of these questions correctly (Figure 2.) This finding is consistent with other research identifying risk-related concepts as the most difficult for individuals to grasp. It is also consistent with the findings from the 2017 P-Fin Index.

The P-Fin Index: Functional Knowledge

Given that risk and uncertainty are inherent in most financial decision making, this is particularly troubling. Comprehending risk involves understanding that the expected outcome in a given scenario depends on the range of possible outcomes, the financial implication associated with each outcome and the likelihood of each outcome occurring. Responses to the following question demonstrate the difficulty many individuals have in comprehending risk.

Investment A will deliver a return of either 10% or 6%, with each outcome equally likely. Investment B will deliver a return of either 12% or 4%, with each outcome equally likely. You can expect to earn more by investing in which?

- Investment A (chosen by 23%)

- Investment B (chosen by 14%)

- It does not matter – expected return is the same with each (correct answer; chosen by 29% of respondents)

- Don’t know (chosen by 33% of respondents)

Understanding risk and its implications is integral to making appropriate decisions across the realm of personal finance, not just investments. Future conditions—employment status, health status, interest rates and future prices— are obviously unknown.

Furthermore, the specific outcome associated with a given decision is often unknown at the time of the decision.

Insuring, investing and go-to-information sources are the other functional areas where personal finance knowledge is below average, i.e., below the average of 50% correct answers for the entire P-Fin Index survey.

Personal finance knowledge is highest in the area of borrowing and debt management. On average, 60% of the borrowing questions were answered correctly (Figure 2.) This finding is also consistent with the 2017 P-Fin Index results (Appendix B, Figure B2.) Debt tends to be a feature of personal finance common across the life cycle for many individuals; knowledge and understanding may emerge from confronting accumulated debt, often from the very early stages of adulthood.

Saving, consuming and earning are the other areas where personal finance knowledge is above average, i.e., above the average of 50% answered correctly for the entire P-Fin Index survey.