How well individuals navigate life’s financial decisions is dependent, at least in part, on their knowledge and understanding of personal finances, often referred to as financial literacy.

The 2017 TIAA Institute-GFLEC Personal Finance Index

The Personal Finance Index (P-Fin Index): A New Measure of Financial Literacy

Introduction

How well individuals navigate life’s financial decisions is dependent, at least in part, on their knowledge and understanding of personal finance. The Personal Finance Index offers unique insights concerning Americans’ capacity for sound financial management and decision making.

Summary

The Personal Finance Index (P-Fin Index) is a survey-based assessment tool that produces a robust measure of overall knowledge of personal finance while enabling refined analysis across eight functional areas. The survey also collects information about household finances and financial behaviors, providing insights into the relationship between knowledge and outcomes. P-Fin Index results are available for the U.S. adult population as well as demographic subgroups defined by age, gender, race and ethnicity, education level, employment status, household income and exposure to financial education.

Key Insights

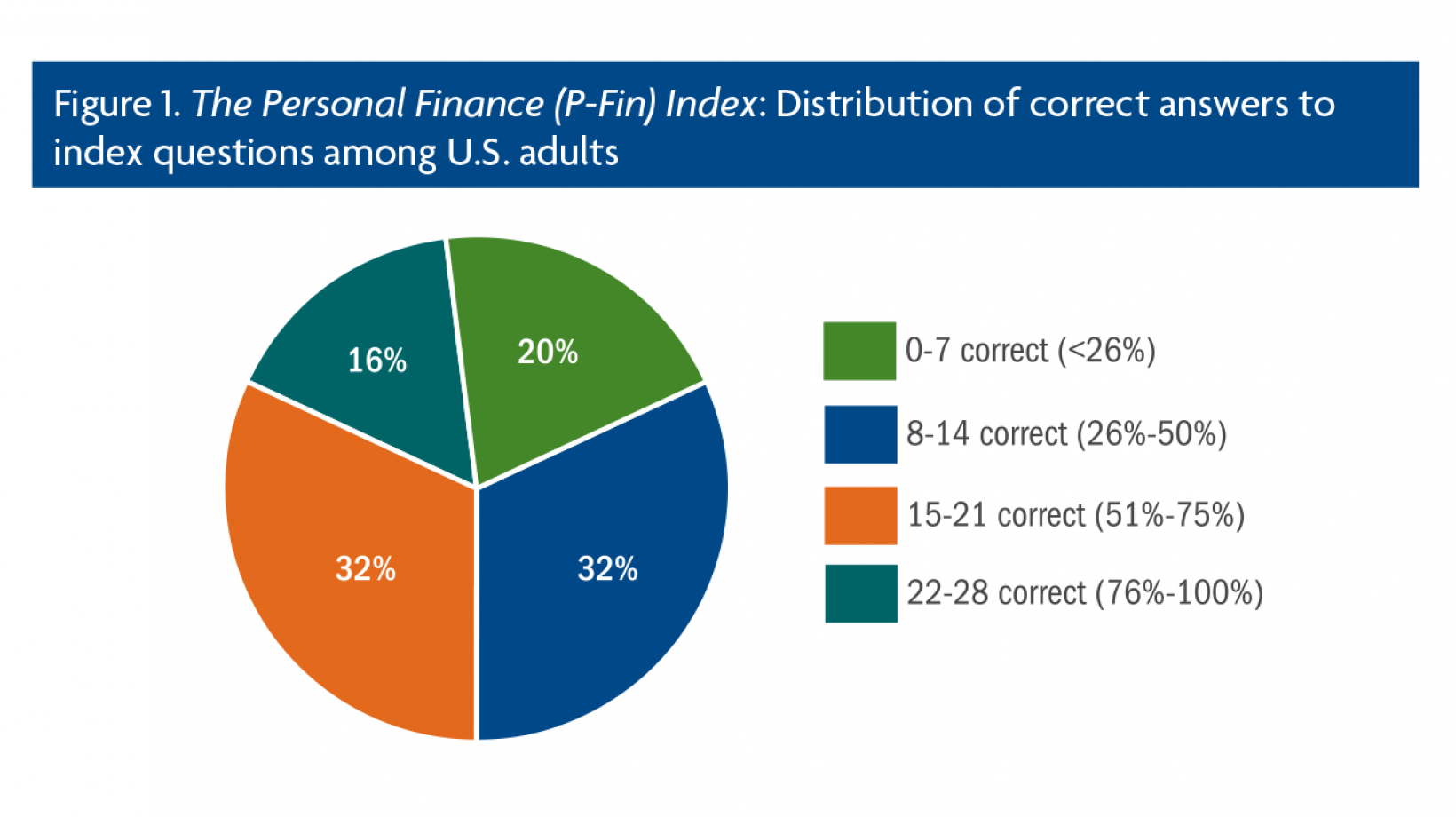

- U.S. adults are split 50/50 between those who could and could not answer one-half of the P-Fin Index questions correctly.

- Sixteen percent of U.S. adults demonstrated a relatively high level of personal finance knowledge and 20% a relatively low level.

- Thirty percent of adults under age 45 have a relatively low level of financial literacy and only 10% a relatively high level. Young adults’ financial knowledge is lowest in areas concerning risk and insurance.

Explore Report Content

Executive Summary

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) measures knowledge and understanding which enable sound financial decision-making and executive management of personal finances. It is unique in its capacity to examine financial literacy across eight areas of personal finance in which individuals routinely function, as well as providing a robust indicator of overall personal finance knowledge and understanding.

The P-Fin Index

The P-Fin Index relates to common financial situations that individuals encounter and, in that sense, can be viewed as a gauge of “working knowledge.” The index builds from the existing academic research on financial literacy and capability. But it’s the capacity to produce a nuanced examination of financial literacy across different areas of personal finance in which individuals inherently function that distinguishes the P-Fin Index. Most other indices rely on a small number of questions and often focus on specific aspects of financial knowledge.

P-Fin Index Results

Distributions of Correct Answers

Personal finance knowledge and understanding among U.S. adults is relatively modest. There is essentially a 50/50 split between those who could and those who could not answer one-half of the P-Fin Index questions correctly (Figure 1). On average, U.S. adults answered 49% of the index questions correctly. Sixteen percent demonstrated a relatively high level of personal finance knowledge, i.e., they answered over 75% of the index questions correctly, while 20% showed a relatively low level, i.e., they answered 25% or less of the questions correctly. It’s concerning that so many Americans appear to lack knowledge that enables sound financial decisionmaking.

Comprehending Risk

Personal finance knowledge is lowest in the area of comprehending risk. The findings highlight that risk is a difficult concept for most (approximately 60%) adults to grasp.

Demographic Variations

Percent Questions Answered Correctly

Personal finance knowledge and understanding varies across individuals with their demographic characteristics. P-Fin Index findings are generally consistent with financial literacy patterns identified by previous studies, with some minor differences. Figure 3 shows the average percentage of P-Fin Index questions answered correctly across demographic groups, while Figure 4 presents the distribution of correct answers within each group.

Young Adult Personal Finance Knowledge

The low level of personal finance knowledge and understanding among young adults is particularly problematic given that many important and consequential financial decisions are faced early in life.

Variations by Education

Variations By education

Personal finance knowledge and understanding is positively correlated with both general education and financial education in the P-Fin Index, a finding consistent with previous research. Figure 5 shows the percentage of questions answered correctly across general education levels, and by the receipt/non-receipt of financial education. Figure 6 presents the distribution of correct answers across the same groups.

A Comparison with Previous Surveys

Several questions in the P-Fin Index can be compared with other surveys. The prevalence of debt in household balance sheets, often from the beginning of a working career, raises the issue of whether individuals are able to make savvy decisions regarding the use and management of debt.

The P-Fin Index and Personal Finance Outcomes

Since the P-Fin Index measures knowledge and understanding which enable sound financial decisionmaking and effective management of personal finances, it should correlate with financial actions and outcomes. Consistent with previous findings, as well as academic research on financial literacy, this expectation holds—individuals with greater personal finance knowledge, as measured by the index, are more likely to have positive personal finance experiences.

Authors

GFLEC, The George Washington University

The George Washington School of Business

TIAA Institute