How prepared for retirement are college and university faculty, and what influences their level of confidence?

Summary

This study examines the retirement planning, saving and investing behavior of tenured and tenure-track faculty, including their self-reported retirement readiness, use of financial advice, confidence in Social Security and Medicare, and preparedness to pay for medical expenses in retirement. The findings suggest most faculty are taking important steps to prepare for retirement, but their likely expenses in retirement might be higher than they envision.

Key Insights

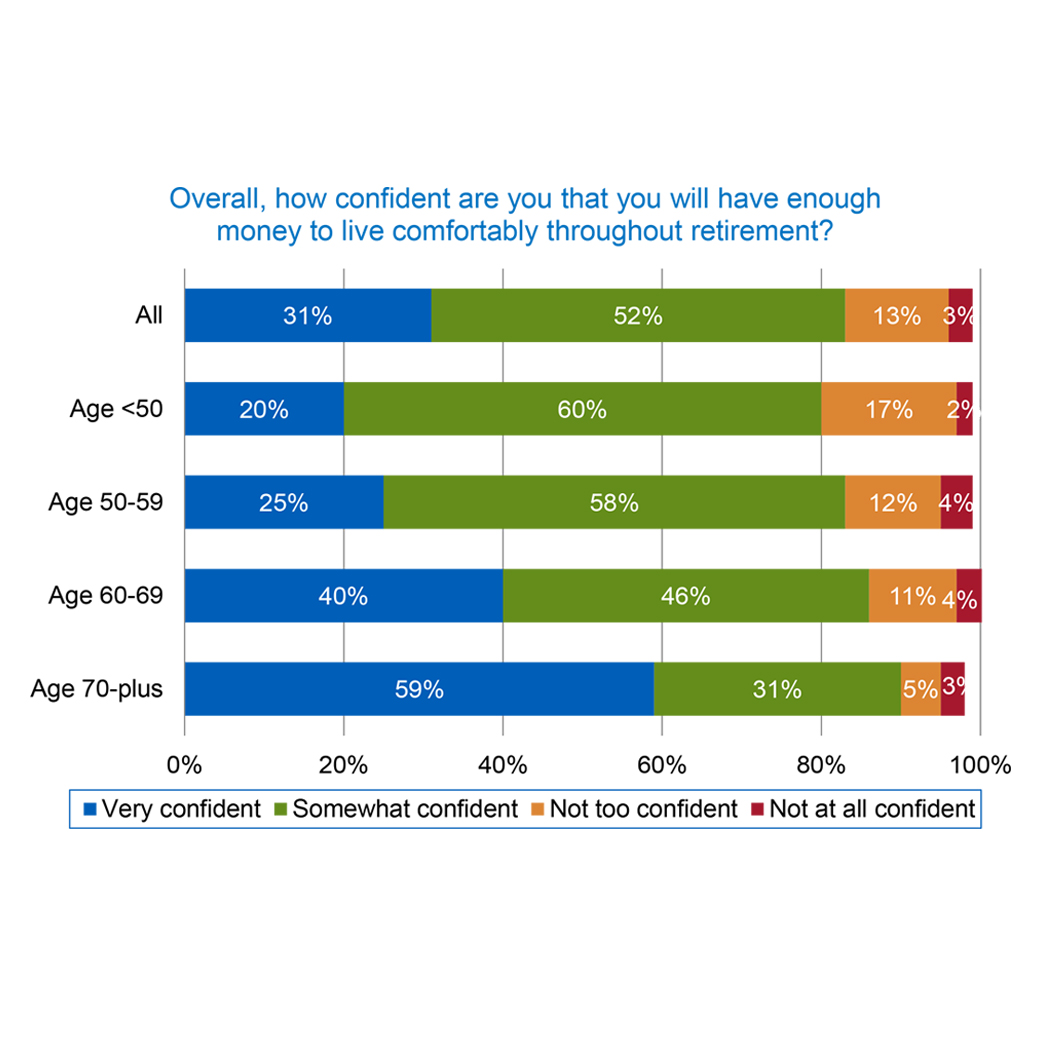

- College and university faculty are more confident in their prospects for a financially secure retirement than are American workers in general. This high confidence is likely driven by their financial preparations.

- Ninety-nine percent of faculty participate in a retirement plan at their institution.

- Ninety-four percent of faculty are currently saving for retirement.

- Those saving for retirement are generally confident they are saving the right amount and investing appropriately.

- Many faculty members have received professional retirement-planning advice.

- Conversely, about 40% of faculty seem to underestimate the amount of pre-retirement income they will need to replace in retirement to live comfortably.

- While 75% of faculty are at least somewhat confident they will have enough money for retiree medical expenses, few have planned and saved for such expenses.