Retirement-income products often try to achieve multiple conflicting goals, including guaranteed income, inflation protection, liquidity, asset growth and estate potential.

Summary

This study gauges the effectiveness of three retirement-income strategies:

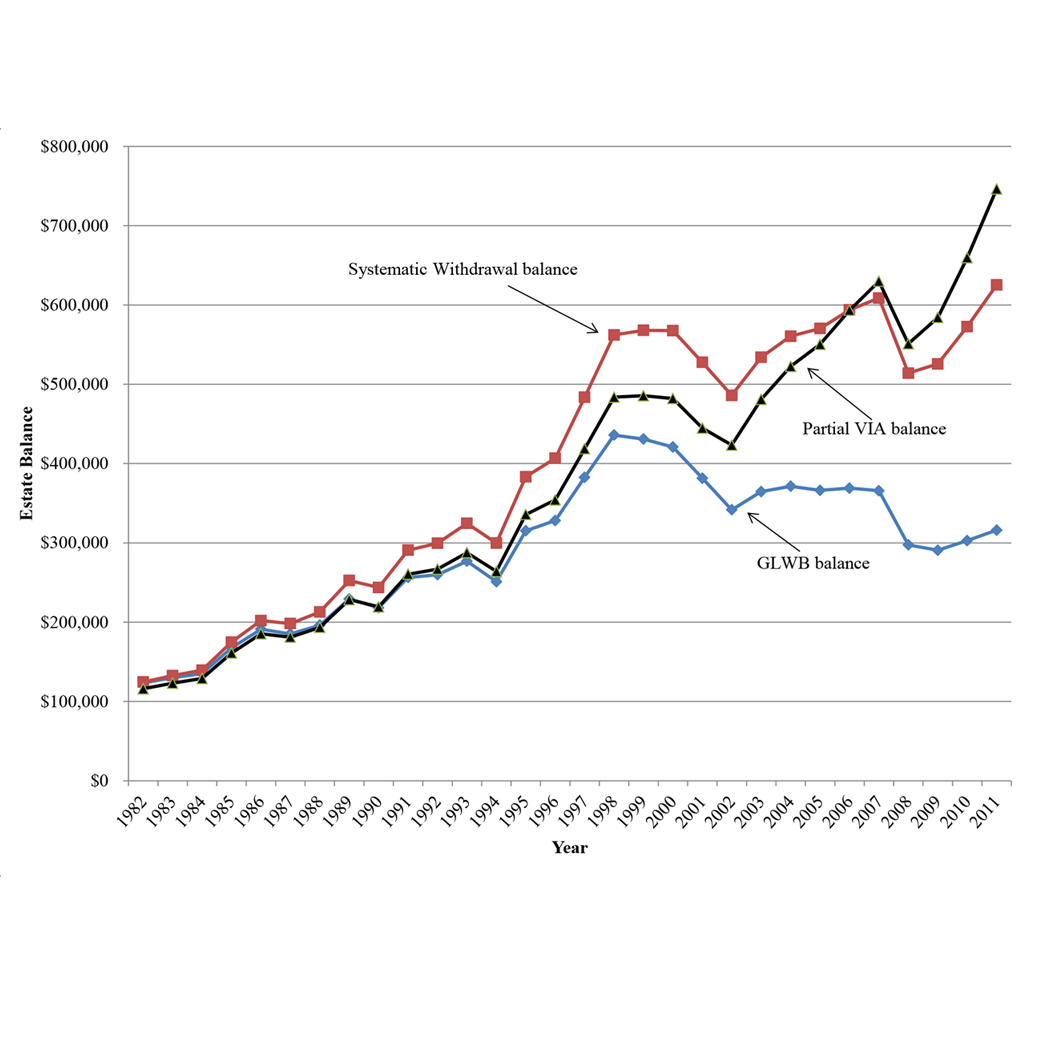

- Guaranteed Lifetime Withdrawal Benefit (GLWB) – This insurance product provides a guaranteed minimum lifetime income, asset liquidity and potential for added income through portfolio gains, but also entails higher annual fees than alternative strategies.

- Partial Variable Immediate Annuity (Partial VIA) with a liquid-asset account – This combination offers protection against longevity risk, some asset liquidity and potential for increases through portfolio gains, but does not guarantee a minimum income because the VIA payments are based on the performance of underlying investments.

- Systematic Withdrawal – A retiree using this strategy draws a fixed amount of cash annually from personal assets. This approach, relative to the others, gives the retiree the most flexibility and control over savings, but the retiree bears all income-related risks.

Key Insights

- An immediate variable annuity combined with a supplemental liquid-asset account offers the best mix of income generation, risk management and estate potential for most retirees.

- Assuming a portfolio evenly split between equity and bonds and a 5% GLWB withdrawal rate, there were no 30-year periods in which the Partial VIA strategy generated less income than the GLWB strategy.

- There were 28 thirty-year periods out of 709 (about 4%) in which systematic withdrawal produced less income than a GLWB; the starting dates all occurred before the 1929 stock market crash.

- Likewise, when the GLWB withdrawal rate was lowered to 4.5% and the retirement period extended to 35 years, there were no instances in which either systematic withdrawal or Partial VIA produced less income than a GLWB.

- The GLWB strategy, despite the added costs, never provided better protection than the systematic withdrawal or Partial VIA strategies at any starting date over the past 85 years.