Because a plan's administrative costs are ultimately paid by participants, plan sponsors are obligated to allocate administrative fees in a fair and appropriate manner.

Summary

Regulatory and fiduciary concerns have led many plan sponsors to spread administrative services across several providers and to adopt open architecture investment menus with dozens of fund managers. While these approaches help distribute fiduciary risks, they make it harder for plan sponsors to levy fees that are reasonable and applied fairly, which can result in cost allocations that are neither efficient for the plan sponsor nor equitable for participants. To address these concerns, this paper offers four criteria for evaluating fee structures and examines the extent to which two common approaches satisfy desired conditions.

Key Insights

- Effective fee structures must meet four basic conditions: adequacy, administrative ease, transparency and fairness. Satisfying the first three makes a fee structure efficient; ensuring "horizontal and vertical equity" makes the structure fair.

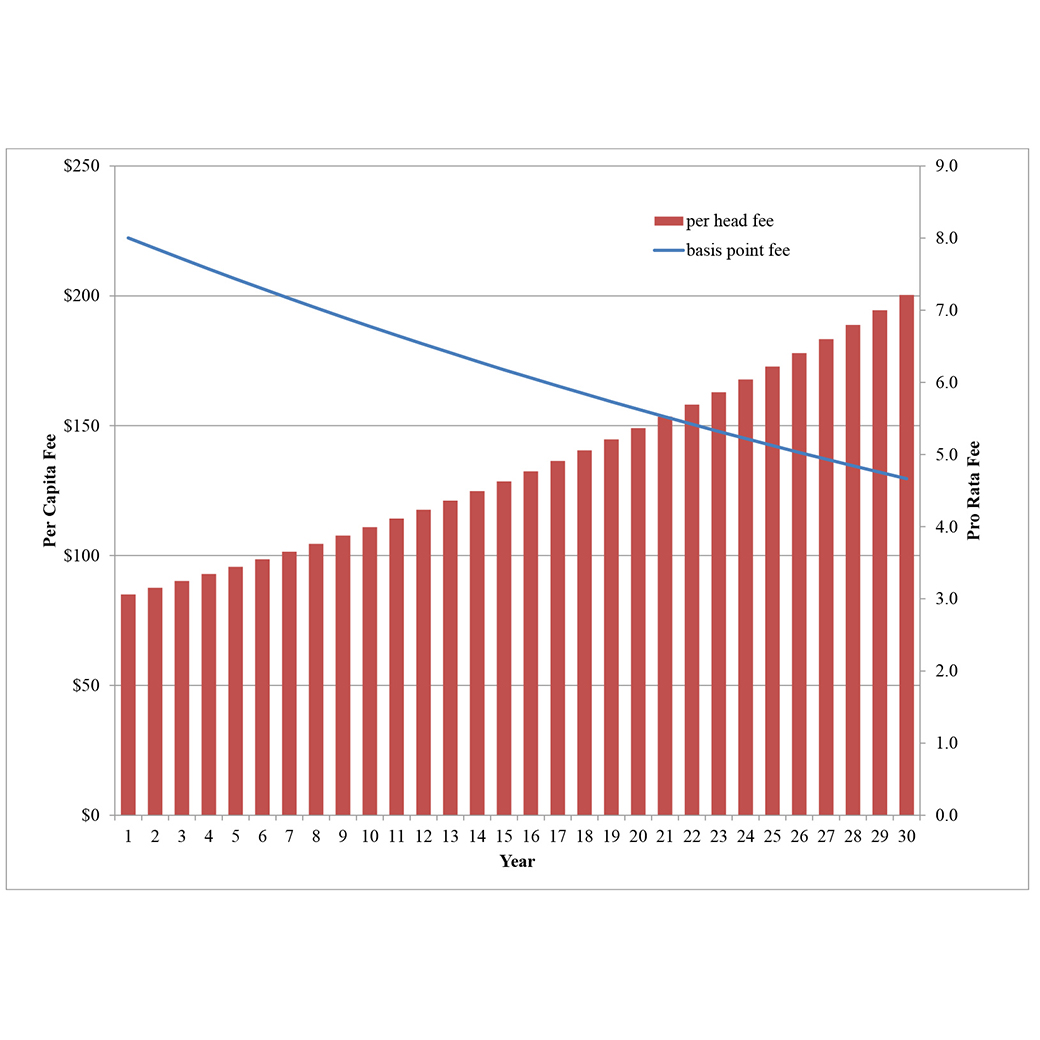

- Two types of plan fees generally are used: per capita and pro rata. Per capita fees are fixed dollar amounts charged to all participants; pro rata fees are usually charged as a percentage of assets.

- If structured properly, both types of fees can meet the efficiency criteria of adequacy, administrative ease and transparency. But only pro rata fees can satisfy the fairness criterion, because per capita fees are highly regressive.

- Plans that violate vertical equity may discriminate in favor of highly compensated or key employees, putting a plan's tax-qualified status at risk.