More than 30 million Americans are projected to retire in the next decade – and most have not saved nearly enough for retirement. Moreover, almost half of all Social Security recipients claim benefits at the earliest possible age (62), which can greatly reduce their total lifetime benefits.

Summary

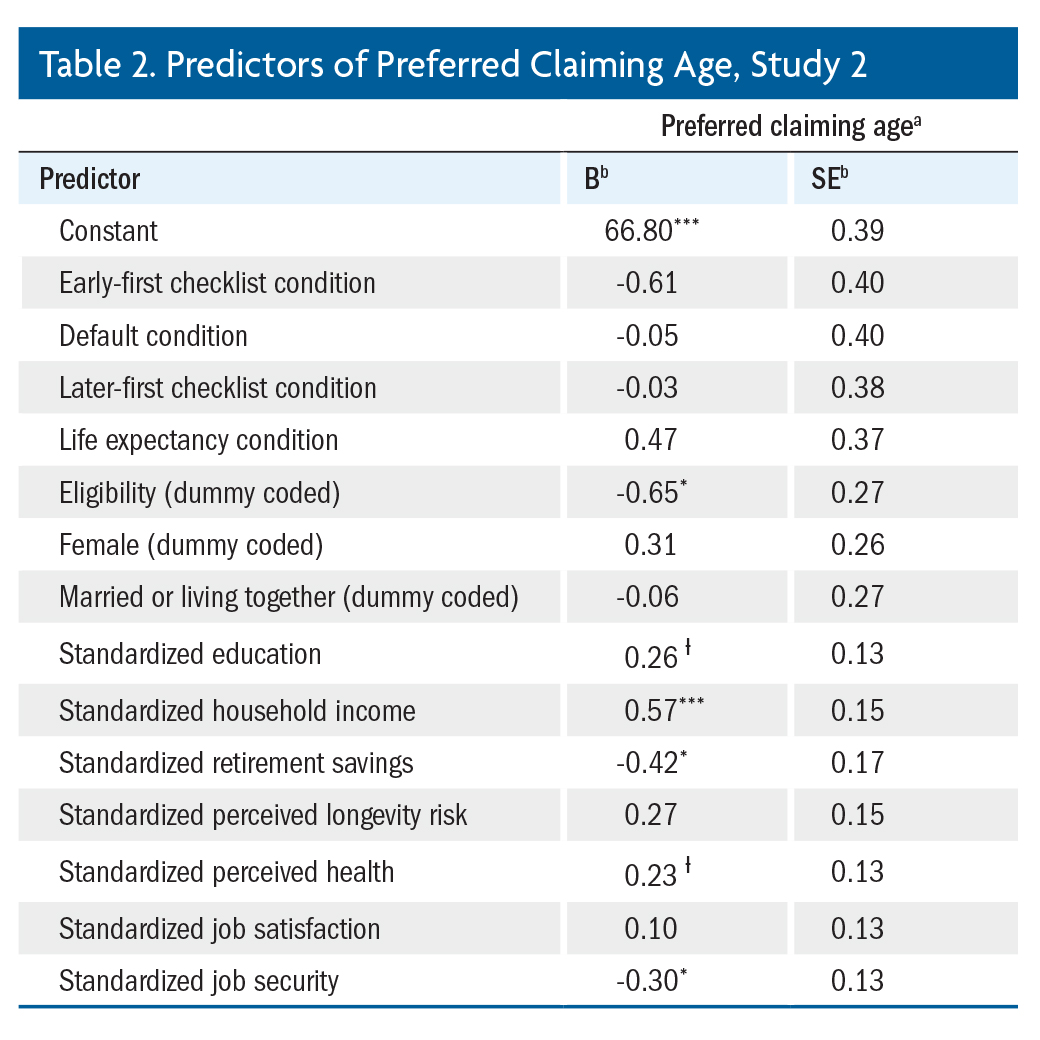

Does the way benefit information is delivered influence the age at which people claim Social Security benefits? This study demonstrates that choice architecture (i.e., the order in which decision criteria are presented) can motivate people to delay claiming benefits. But because a retiree’s optimal claiming age varies based on expected longevity, personal savings and other factors, successful choice architecture interventions need to be both effective and selective: that is, delaying claiming age for those who should delay, but not for those who should claim early.

Key Insights

- Nearly half of all Americans claim Social Security benefits at the earliest possible age (62), potentially resulting in lower lifetime benefits.

- The way decision information is presented (choice architecture) can motivate people to delay claiming benefits.

- Changes to the way decision making is presented have a stronger effect on preferred claiming age than factors such as education, wealth and perceived longevity.

- When participants were prompted to consider the future first, they opted to claim Social Security benefits 18 months later, on average, than those who weren’t prompted to do so.

- However, when participants were asked to calculate their life expectancy before making a claiming decision, the results of the choice architecture intervention were negated.