Gen Y is the largest, most educated and ethnically diverse demographic group in U.S. history, projected to make up 75% of the world’s workforce by 2050.

Summary

Members of Gen Y (also called millennials, born between 1980 and 2000) tend to be financially fragile. This study demonstrates the critical importance of engaging Gen Y early in their lives to help them manage their personal finances and ensure their financial well-being.

Key Insights

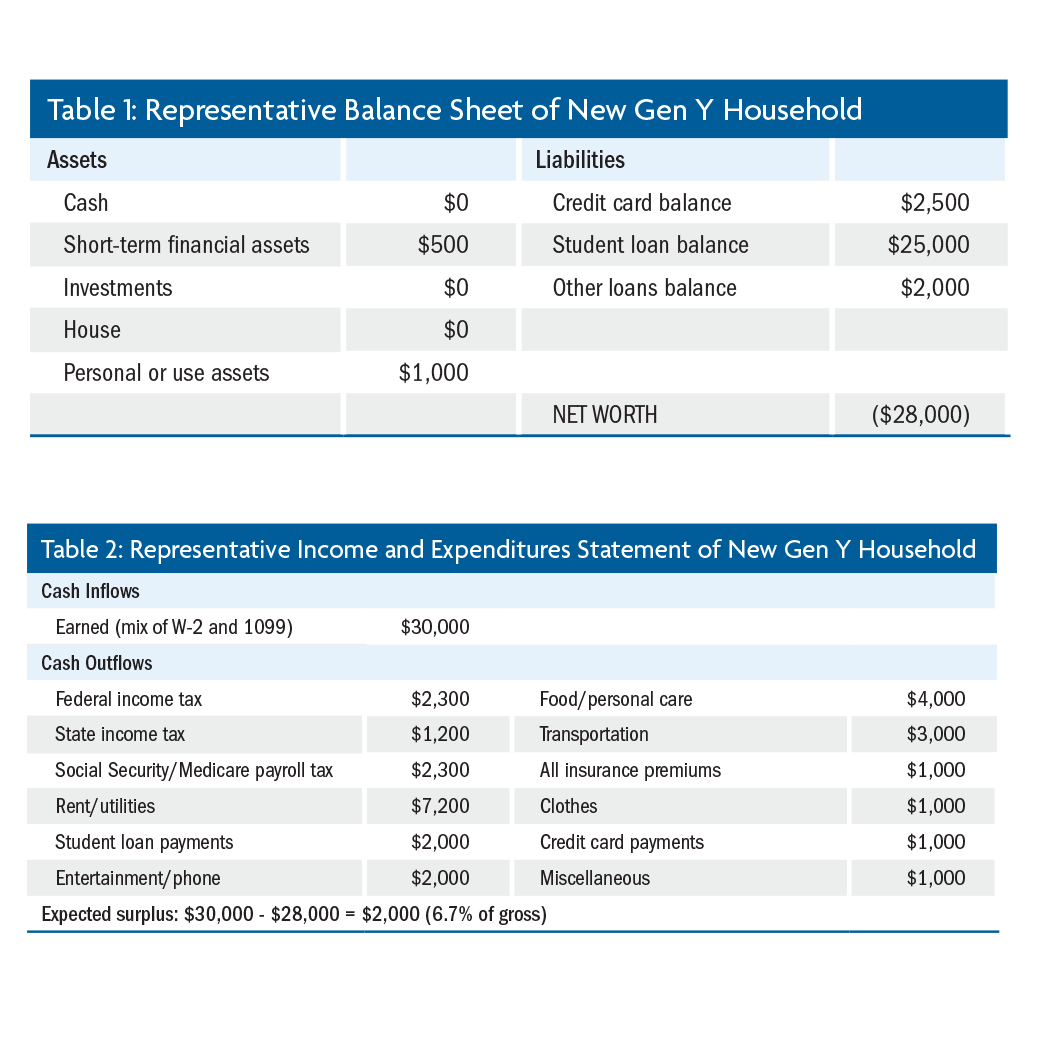

- The typical Gen Y new household has a negative net worth, often the result of student loans.

- As little as a 10% cut in income can wipe out a Gen Y household’s savings and endanger its financial security. Unexpected expenses like car repairs can have the same effect, as few Gen Y households have the liquidity to absorb financial shocks.

- Gen Y households are more apt to need advice on basic budgeting, debt, liquidity and insurance than to need traditional financial advice, such as portfolio management.

- Substituting variable costs for fixed costs can help Gen Y reduce leverage and permanent shocks to their standard of living.

- Other solutions: Use digital and social media for peer-to-peer information that "doesn’t preach."