Participants in self-directed retirement plans may fail to understand and mitigate investment and longevity risk, putting their retirement security at risk. Variable deferred annuities with lifetime income and investment guarantees could rectify the problem.

Summary

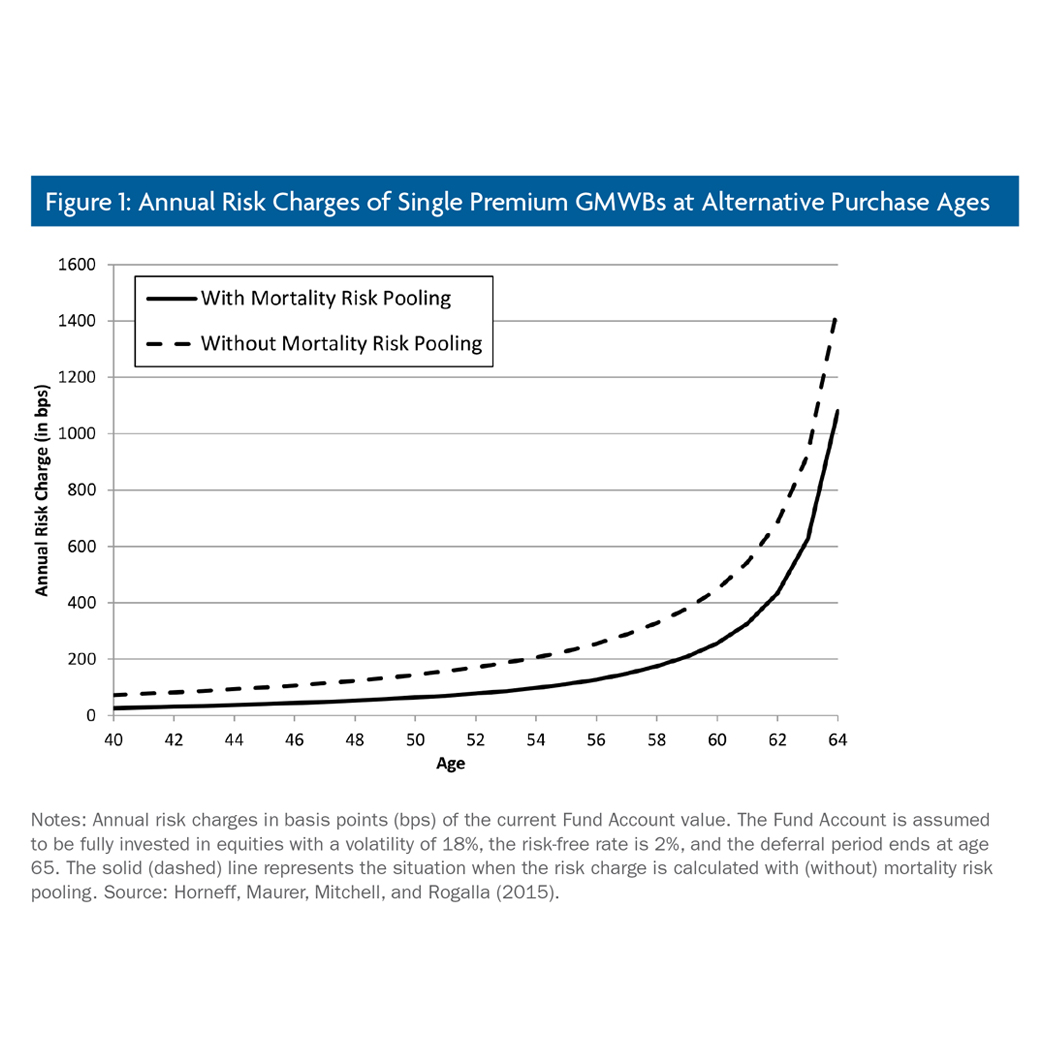

A deferred variable annuity with a guaranteed minimum withdrawal benefit rider ("GMWB") is an insurance product with both investment and income components. To gauge how access to a GMWB affects lifecycle consumption and portfolio allocation patterns, the authors of this study incorporate a fairly priced GMWB as an investment option for an investor facing an uncertain lifetime, risky labor income and random equity returns. Their model accounts for individual risk-aversion, borrowing constraints, capital market volatility and other background risks.

Key Insights

- GMWBs provide access to equity investments with downside protection, hedging of longevity risk, and partially refundable premiums.

- The optimal time to buy GMWBs is well before retirement, because of the product’s flexibility and access to the stock market.

- GMWB access raises consumption in retirement, as retirees with GMWBs have a guaranteed lifelong income. Until around age 80, they can consume annually some $1,000 (3%) more than retirees who lack GMWBs. In later years, the differences are even larger.