Differences in wealth and income by race and ethnicity are well established. How do these differences affect retirement income security?

Summary

Lower incomes mean lower monthly benefits earned under Social Security and a lower capacity to save for retirement. But because of Social Security’s progressivity, lower lifetime earners need to save less than higher lifetime earners to replace a given percentage of pre-retirement income in retirement. This data brief discusses the implications of these and other factors for differences in retirement preparedness and security by race and ethnicity.

Key Insights

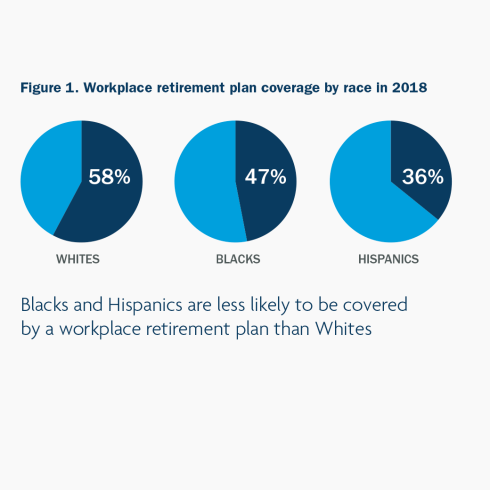

- Blacks and Hispanics are less likely than Whites to be covered by a workplace retirement plan.

- Blacks and Hispanics have less than half the retirement savings of Whites.

- Hispanics and Blacks are more likely than Whites to rely on Social Security as their main source of household income.

- Blacks and Hispanics are more than 35% less likely than Whites to own a home.