What percentage of a retiree's deferred contribution plan assets should be allocated to longevity annuities, bonds, and stocks—and how do Social Security benefits affect this decision?

Summary

Social Security pays retirees a lifetime annuity with fixed benefits that vary based on earning history and claiming age. Privately purchased annuities can supplement Social Security and provide a predictable income stream sufficient to cover necessities. This paper examines how best to allocate a retiree's DC portfolio in retirement across longevity annuities, bonds, and stocks when considering Social Security benefits in retirement. Understanding optimal portfolios in retirement when considering Social Security is imperative to improve Americans' retirement security.

Key Insights

- Including deferred income annuities in DC plan accounts is welfare-enhancing for all.

- Providing access to variable deferred annuities with some equity exposure further enhances retiree wellbeing, compared to having access only to fixed annuities.

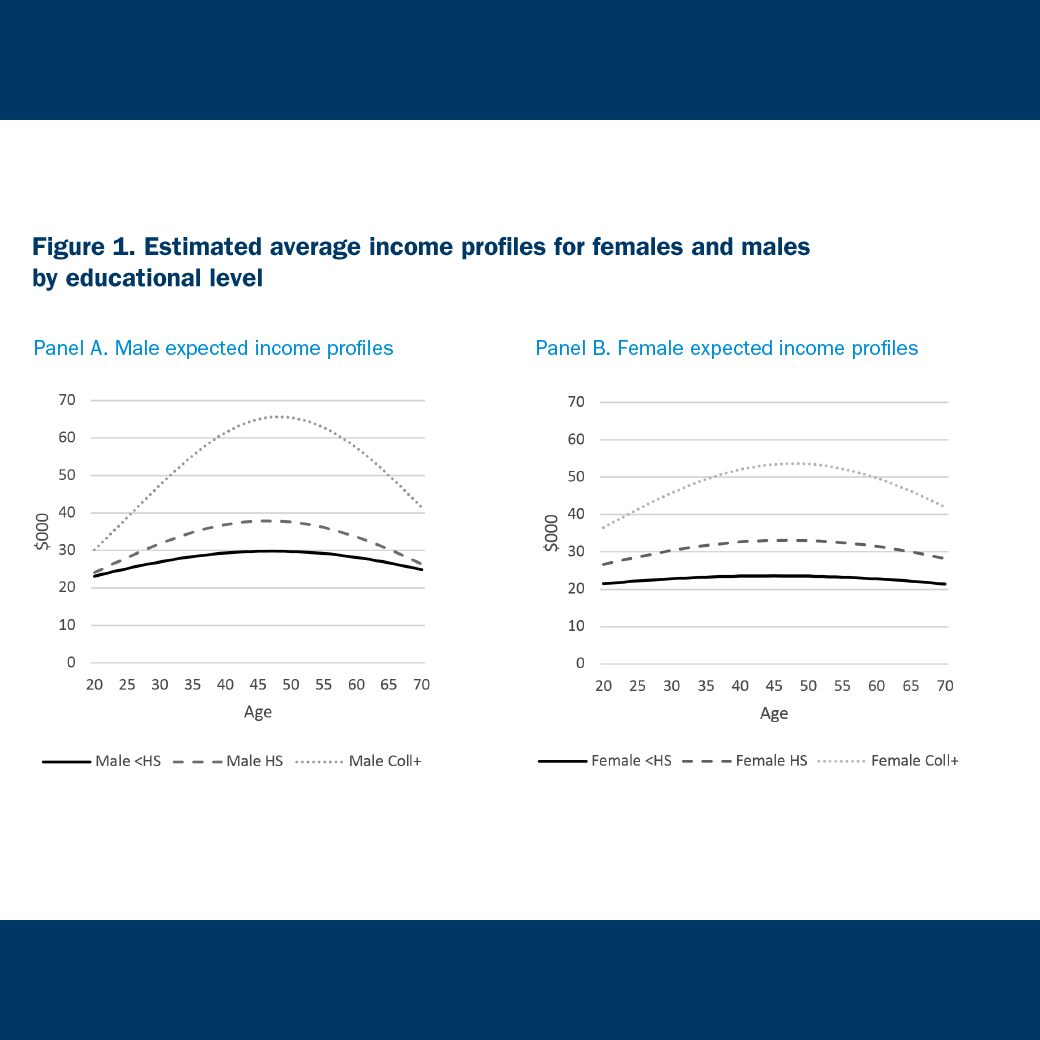

- For the least educated, delaying claiming social security benefits is preferred, whereas the most educated benefit more from using accumulated DC plan assets to purchase deferred annuities.