Many university students struggle financially to remain enrolled in school, particularly those from less-wealthy families. Financial counseling can make a notable difference.

Summary

To help students navigate the complex world of student financial aid, including grants and loans, the Office of Student Financial Services (SFS) at Georgia State University has a Student Financial Management Center that provides proactive advising. Yet, despite the availability of these services and proactive outreach from the Center, many students, even those in dire need of financial assistance, never come for counseling. This study examines whether modest financial incentives increase uptake of financial aid counseling, the impact of such counseling, and whether counseling is more (or less) effective for hard-to-reach populations who require larger incentives to participate.

Key Insights

- Only 1.3%of students who weren’t offered a financial incentive attended an appointment for financial advising.

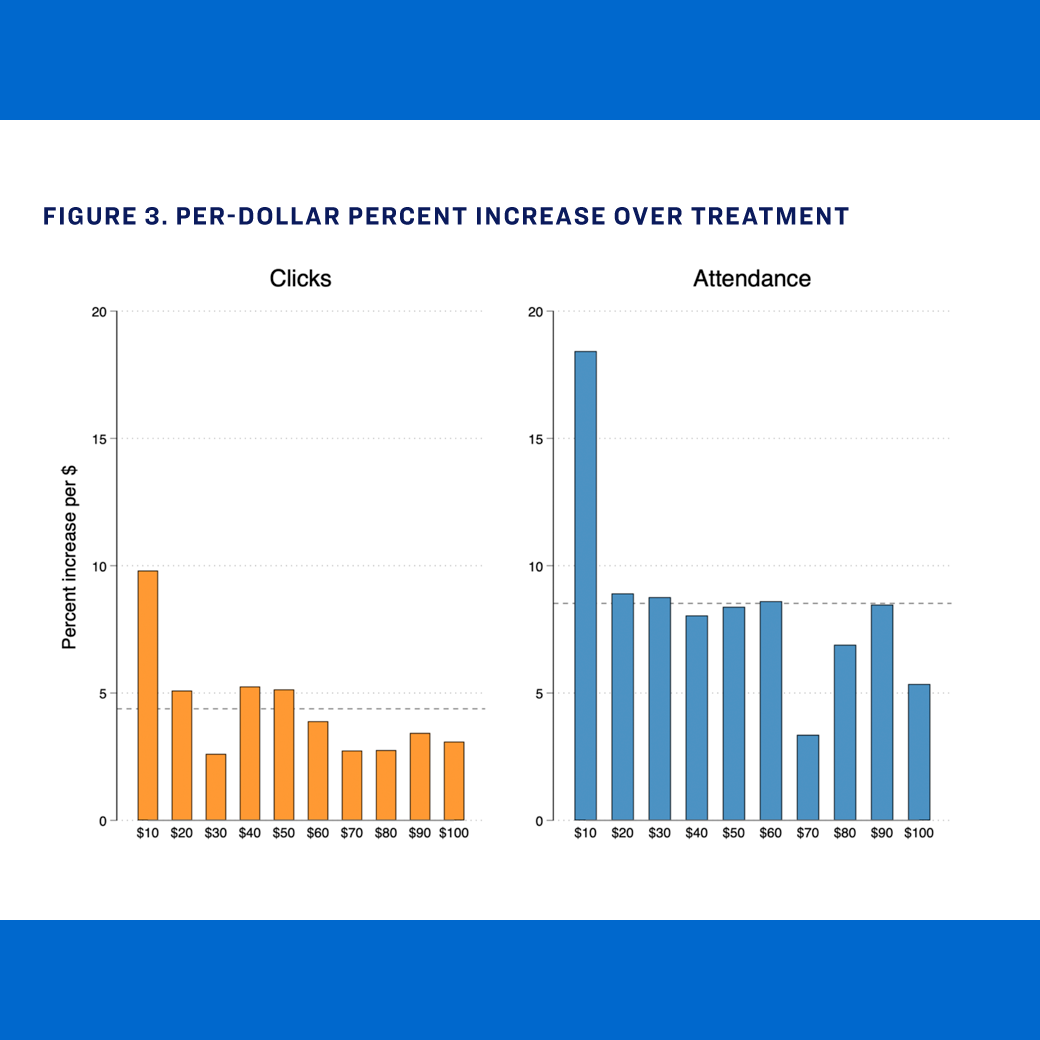

- Financial incentives boosted financial advising engagement. Every $10 in incentives increased the likelihood that students scheduled an appointment by nearly one additional percentage point.

- Students who attended counseling because of the incentives did not have different outcomes from those who attended without a financial incentive, regardless of how much was paid to induce them to attend.