Do age-based retirement plan rules boost employees’ retirement readiness?

Summary

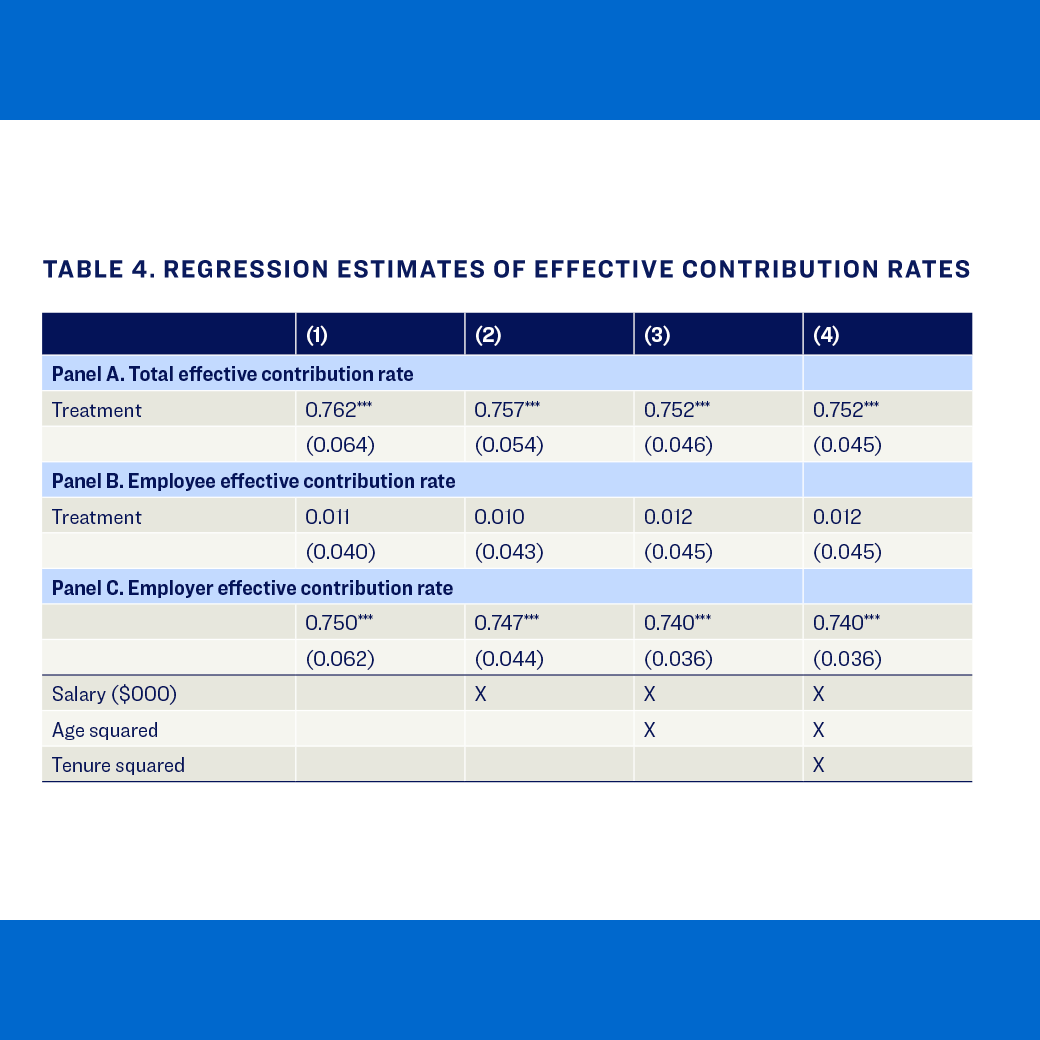

Some plan sponsors increase retirement plan contributions by the employer after employees reach a certain age or number of years of service. Whether such policies raise total retirement savings hinges on the extent to which employees reduce their own contributions in response to employer increases. This paper examines employee behavior in light of employer contribution increases and the effectiveness of employer contribution rules in boosting retirement readiness.

Key Insights

An increase in employer contributions at age-based junctures is not associated with a change in employee contributions. This is applicable to salary earners below and above the median.

Employer contribution increases drive increased retirement savings in aggregate, as these increases are not “crowded-out” by offsetting decreases in employee contributions.

Employer benefits can have a large effect on employee retirement readiness, emphasizing the importance of carefully crafting employer retirement plan designs.