The U.S. student loan market plays a crucial role in enabling individuals to pursue higher education, but for many borrowers it also leads to substantial debt.

Summary

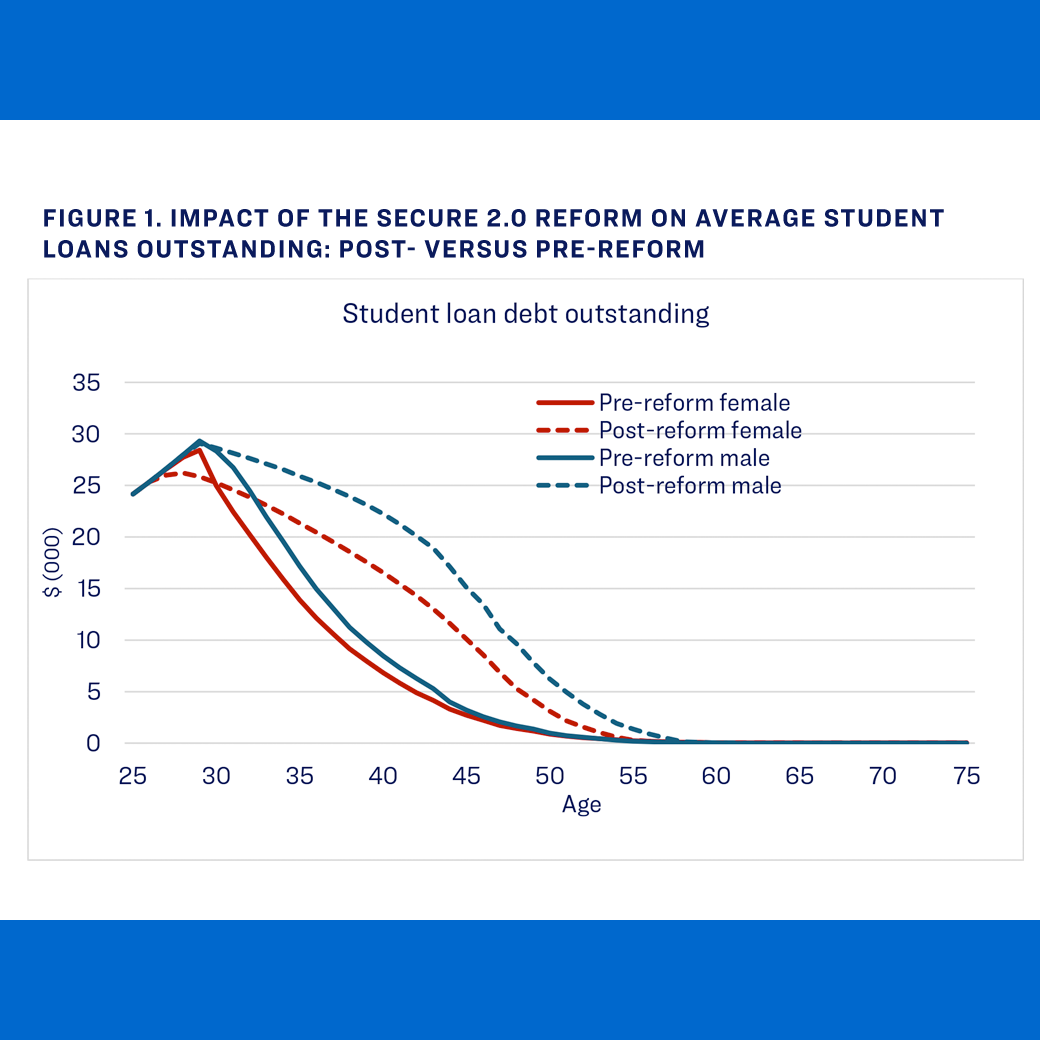

Almost 50 million Americans owed $1.75 trillion in student loan debt in 2022, and most young workers are burdened by the need to repay these obligations. Yet if the young are to accumulate assets sufficient for retirement, they also must start saving in their employer-provided pension accounts. This paper investigates how such workers can manage both debt repayment and saving in tax-qualified retirement accounts to maximize their lifetime well-being. The authors also show how workers’ choices will be shaped by employer-sponsored matching retirement contributions when workers make qualifying student loan payments, as intended by the SECURE 2.0 Act of 2022.

Key Insights

- The SECURE 2.0 provision concerning student debt could enhance pre-retirement consumption by up to 3%.

- This paper estimates the new policy will induce workers to reduce their own retirement savings by almost 50%, yet this reduction is offset by the higher employer-matching contributions in recognition of the loan repayments.

- The reform will not produce earlier estimated loan discharge dates, and it will only slightly reduce estimated non-retirement asset balances.