Even with sufficient financial knowledge and skills, individuals unaware of the importance of responsible financial behavior could still end up making poor financial decisions.

Summary

Financial awareness—which involves recognizing the importance of responsible financial behavior and seeking the knowledge and skills to facilitate such behavior—is crucial to financial well-being. However, the determinative role of financial awareness in financial decision-making has been under-explored in the research literature. To fill that gap, this paper examines levels of financial awareness across the U.S. over time, how financial awareness shapes individuals’ financial behaviors and outcomes, and ways to improve the financial awareness of households.

Key Insights

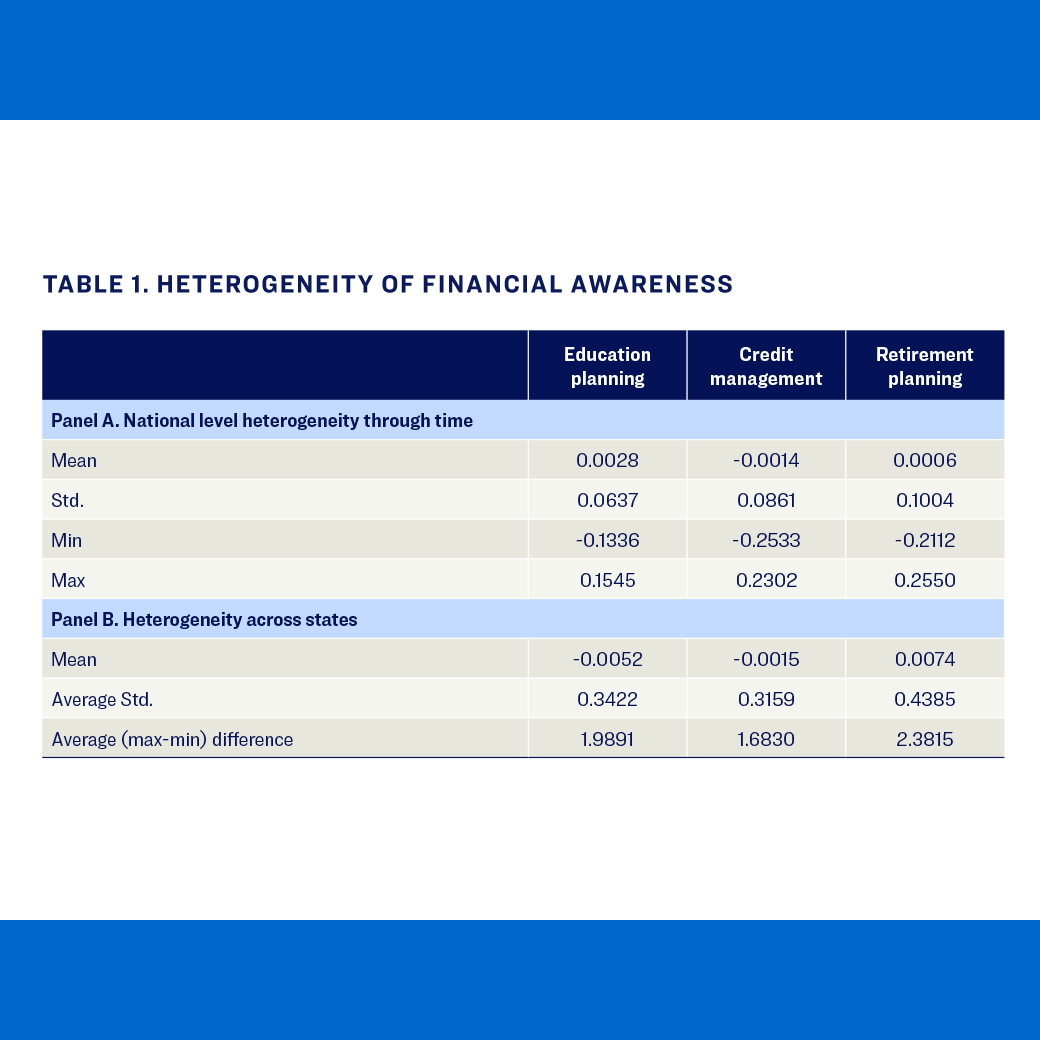

- Financial awareness levels vary widely among the general population.

- A higher level of financial awareness predicts higher balances in 529 saving plans, lower credit card delinquency rates and more savings in IRAs.

- Public education through the media could be a crucial method of influencing the population’s financial awareness.