Does planning for economic shocks, saving for short-term emergencies, and enhancing financial knowledge, reduce the likelihood of becoming financially fragile?

Summary

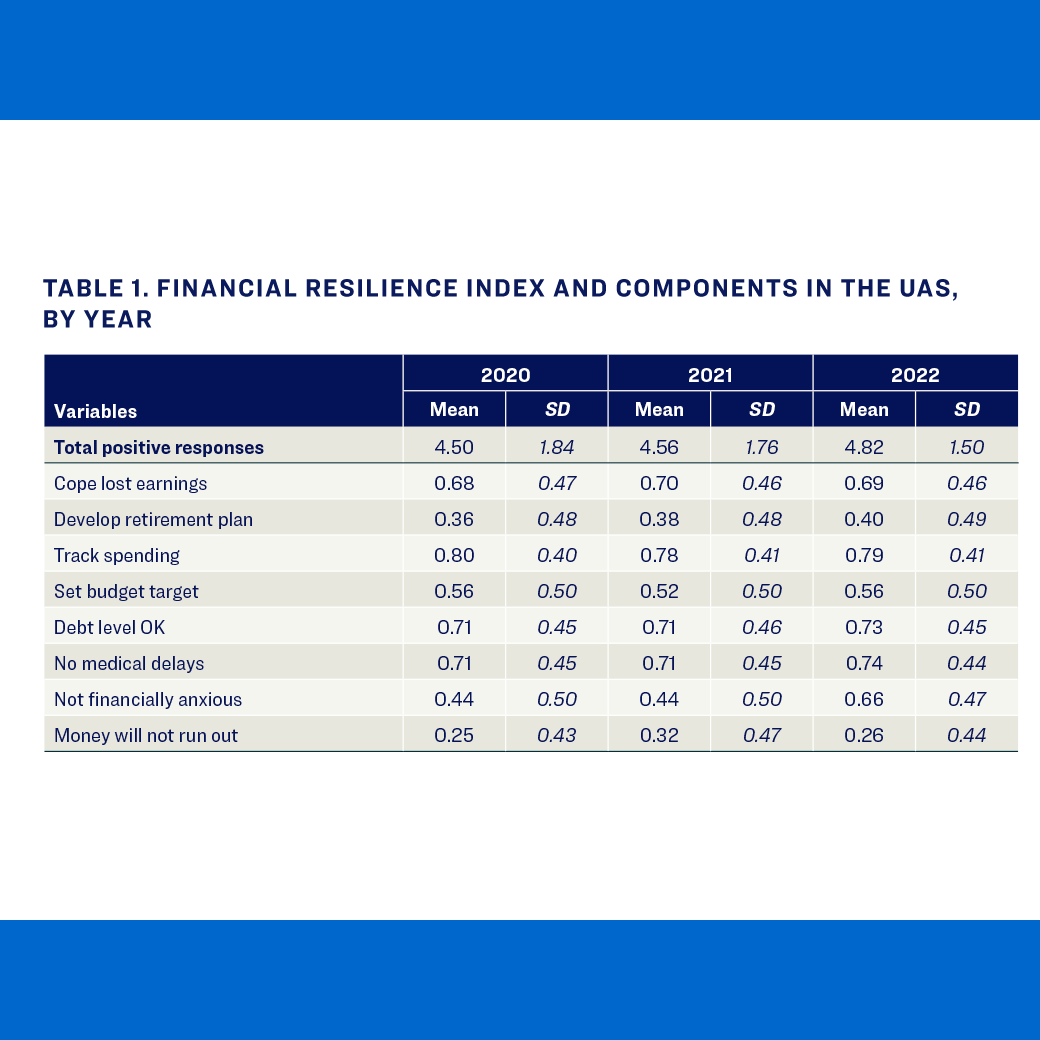

Financial resilience refers to how well people are prepared to respond to economic shocks that threaten their economic security. To gauge financial resilience and its effects, this study’s authors developed an eight-question index that indicates how prepared households are to respond to economic shocks. They then tested whether people with higher scores on the index had better economic outcomes during the past three years when the Covid-19 pandemic significantly affect millions of Americans.

Key Insights

- The average household’s financial resilience remained quite stable during the pandemic.

- More financially resilient households were less likely to be financially fragile.

- Resilient households were more likely to take their pension account payouts as retirement annuities, instead of lump sums.

- Greater financial literacy was associated with better information about one’s pension plan and pension plan payout choices.