An increasing share of older Americans carry debt into retirement, underscoring the need to support older adults in managing their debt effectively.

Summary

Rising debt levels among older Americans can cause significant challenges for their retirement security. While prior studies have highlighted this rise in debt, less attention has been given to older adults’ ability to manage and pay off debt. This report sheds light on the prevalence and amounts of delinquent debt, i.e., any debt that is past due and beyond the grace period.

Key Insights

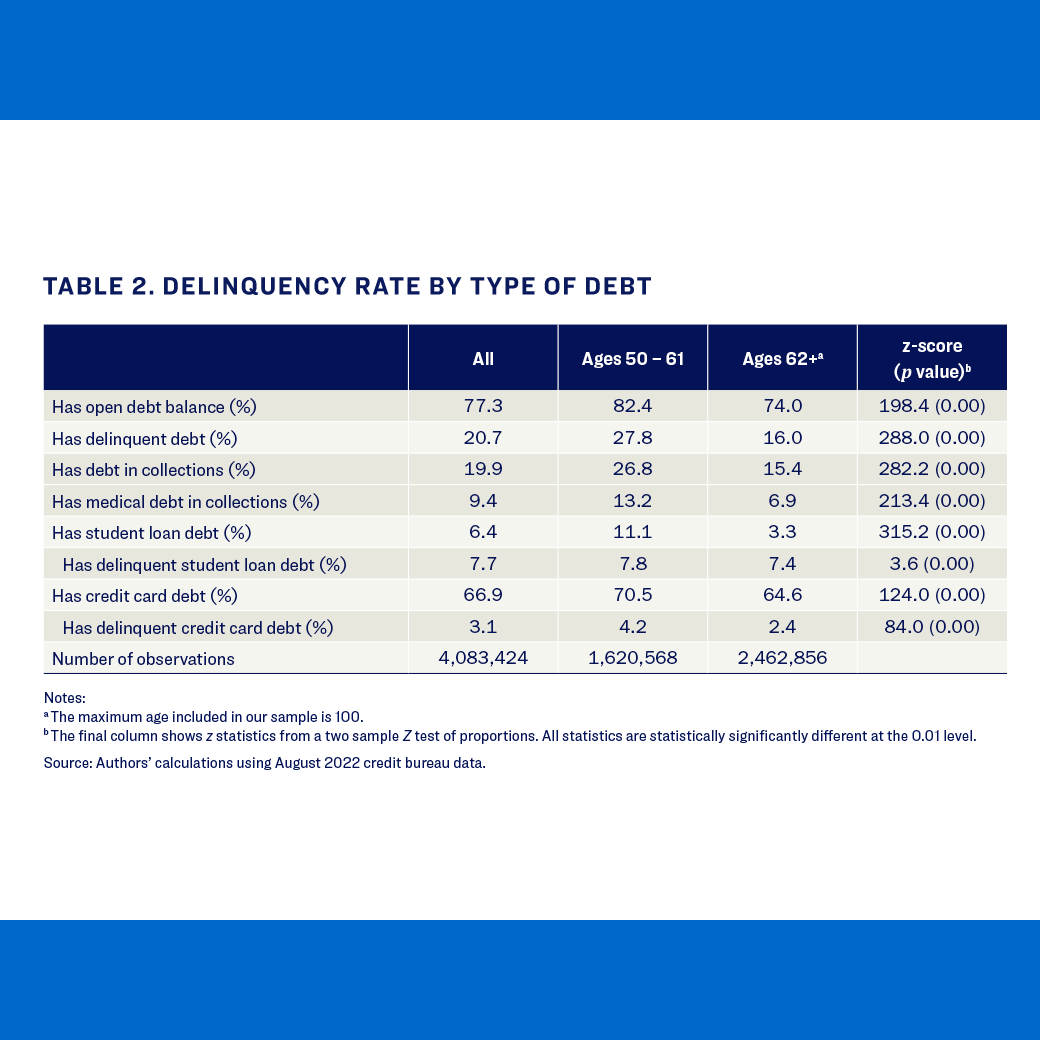

- About one in five consumers age 50 or older with a credit bureau record had delinquent debt in August 2022, suggesting difficulties meeting financial obligations.

- The prevalence of debt delinquency decreased with age, with about one in four adults ages 50 to 61 and one in six adults age 62 or older holding delinquent debt.

- Consumers living in local areas where a majority of residents identify as American Indian or Alaska Native, Black, Hispanic, or Asian American or Pacific Islander were more likely than consumers in majority-white areas to have delinquent debt and/or higher median amounts of delinquent debt.