Retirement income security depends upon a series of financial decisions and actions over time. How do healthcare employees tackle this challenge?

Summary

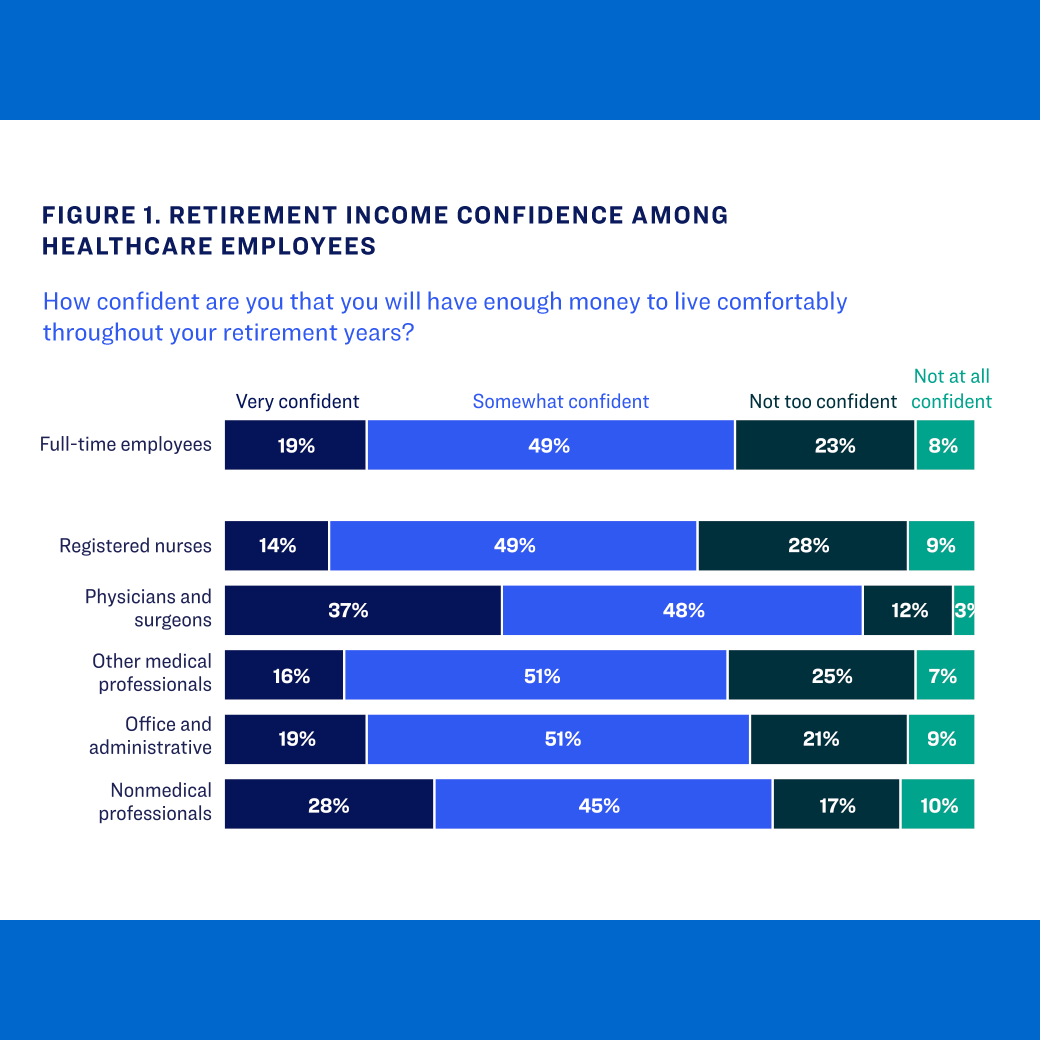

This report leverages the TIAA Institute Healthcare Workforce Survey to examine retirement readiness among full-time employees—including registered nurses, physicians and surgeons, other medical professionals, office and administrative staff, and nonmedical professionals—in hospitals, healthcare systems, and medical practices that are part of a system. A previous report used the same survey data to analyze recruitment and retention issues in the healthcare sector.

Key Insights

- 91% of full-time employees in hospitals and healthcare systems are saving for retirement, with 67% saving through an employment-based plan.

- 34% of retirement savers aren’t confident they’re saving an adequate amount, and 24% aren’t confident their savings is invested appropriately.

- 85% of retirement savers in the healthcare sector carry debt, and 45% are saving less than they otherwise would because of their debt. 58% of savers are likely to use an annuity to provide retirement income.

- 51% of savers have received retirement planning advice within the past two years.

- 38% of those who haven’t received advice aren’t confident about having enough money to live comfortably throughout retirement, compared with19% of advice recipients.