Despite nearly wide coverage by Medicare for those over age 65, out-of-pocket medical costs represent a significant budget item in retirement.

Summary

Households can take a tax deduction for eligible medical expenses that exceed 7.5% of adjusted gross income. But claiming itemized medical deductions (IMDs) requires incurring medical spending above the income threshold, filing a tax return, keeping track of qualifying medical expenses, and determining whether it is advantageous to itemize deductions. This study examines what share of eligible deductions (and their associated tax savings) is claimed, and what share of households have eligible spending that is not claimed. It also explores potential reasons taxpayers leave tax savings on the table and how tax savings from the IMD are distributed among the population.

Key Insights

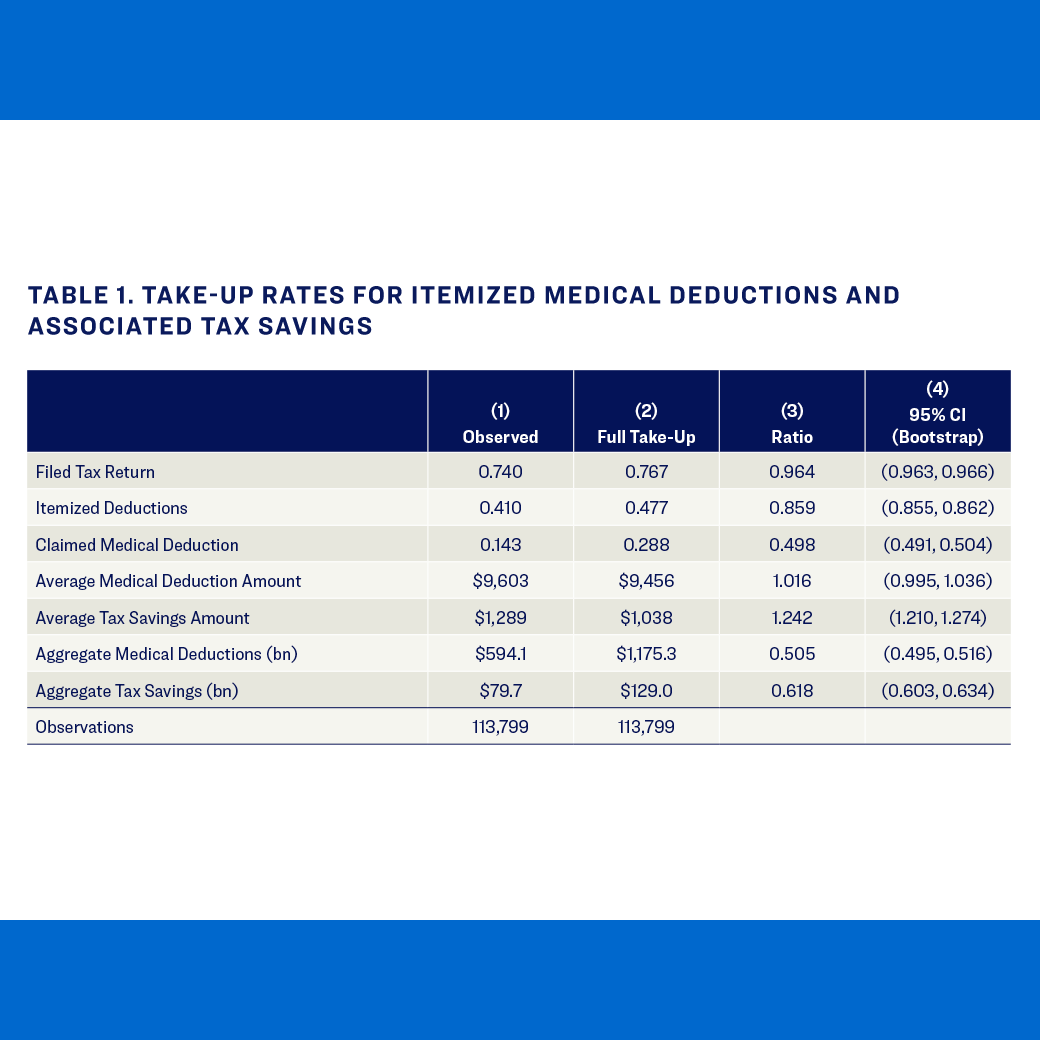

- Half of all eligible medical deductions and 62% of associated tax savings are claimed each year, resulting in about $65 billion in forgone medical deductions.

- Approximately 18% of households fail to take full advantage of the medical deduction representing $4,714 for the average household.

- The share of eligible medical deductions claimed is lower levels of education, lower income and wealth, and worse health, , lower income and wealth, and worse health differences in claiming rates by race or ethnicity.

- Households claim claim a higher share of eligible deductions as they are eligible additional times, suggesting that households learn about the deduction over time.