How do professional advisors own longevity estimates influence the financial advice they provide—and do their recommendations change when given additional information about the health and longevity risks a client faces?

Summary

When deciding how much to save for retirement, when to claim Social Security, whether to annuitize, or how to invest, many people consider their health and life expectancy. Such assessments, however, are often inaccurate or biased. Professional advisors can mitigate these biases, yet some advisors could be influenced by self-interests or their own biases. Using online experiments with the general public and professional advisors, this study explores how longevity and health information impacts financial advice.

Key Insights

- Both amateur and professional advisors tend to overestimate their survival probabilities.

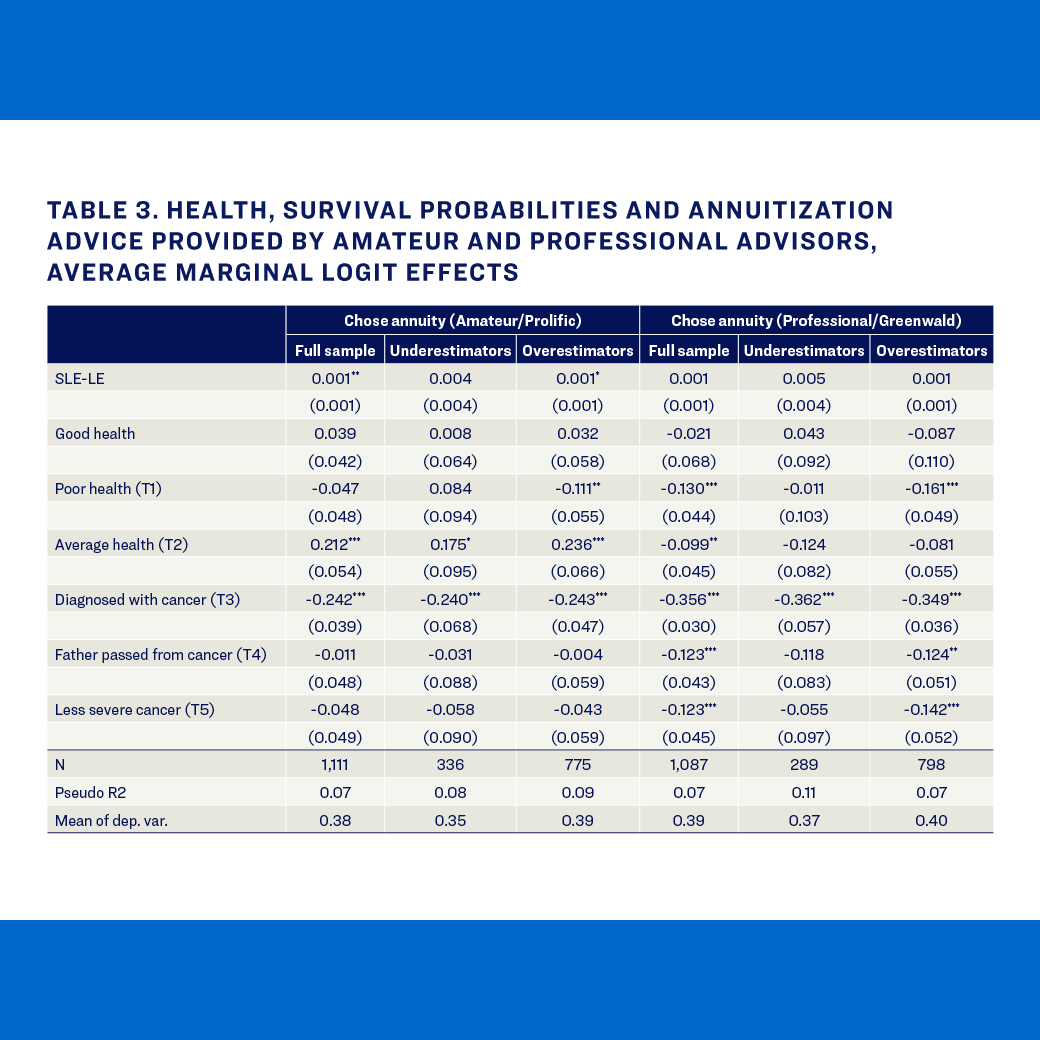

- Among amateur advisors, providing information about an average individual’s chance of reaching age 90 increased the likelihood of recommending annuitization by 56% Both amateur and professional advisors tend to adjust their recommendations based on an advisee’s health and survival probabilities, especially regarding annuitization.

- Amateur advisors react more strongly to simple longevity and health information, while professional advisors are more responsive to a broader range of information for their advisees.