U.S. consumers who face high care costs late in life have limited options for insuring consumption or bequests. Could medically underwritten income annuities fill this need?

Summary

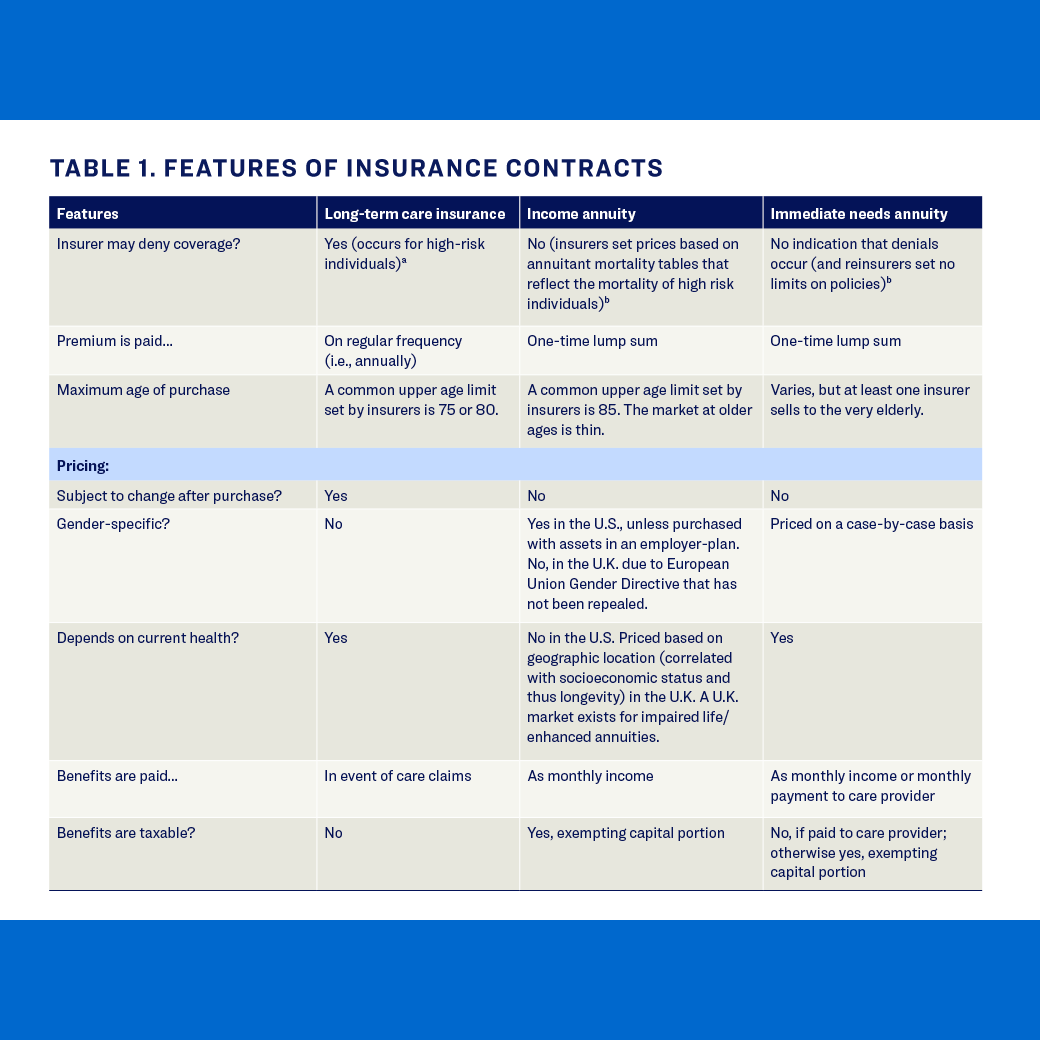

In the United Kingdom, people can purchase an immediate needs annuity (INA) when the need for care arises. INAs are medically underwritten, like long-term care insurance, but annuity payments aren’t dependent on care usage. Compared to purchasers of traditional income annuities, INA purchasers have a lower expected remaining lifespan, yet the variance—relative to expected longevity—might be considerably increased, potentially making INAs a riskier product to offer and lowering their value relative to income annuities. This paper describes how INAs work and the potential value they provide.

Key Insights

- Purchasing an INA upon first needing care makes individuals better off if they have moderate to high wealth levels.

- INA purchasers are able to sustain higher levels of consumption in their remaining lifetimes.

- While the assets of INA purchasers drop initially at purchase, asset levels (and hence potential bequests) decline more slowly afterwards than they would otherwise.

- For individuals at the lower end of the wealth levels at which an INA purchase is optimal, the likelihood of taking government-financed care drops by a moderate amount.

- Higher-wealth purchasers are unlikely to use government care, whether or not they purchase an INA.