Many people struggle to save for the future. Reframing the purpose of saving can help increase the motivation to save.

Summary

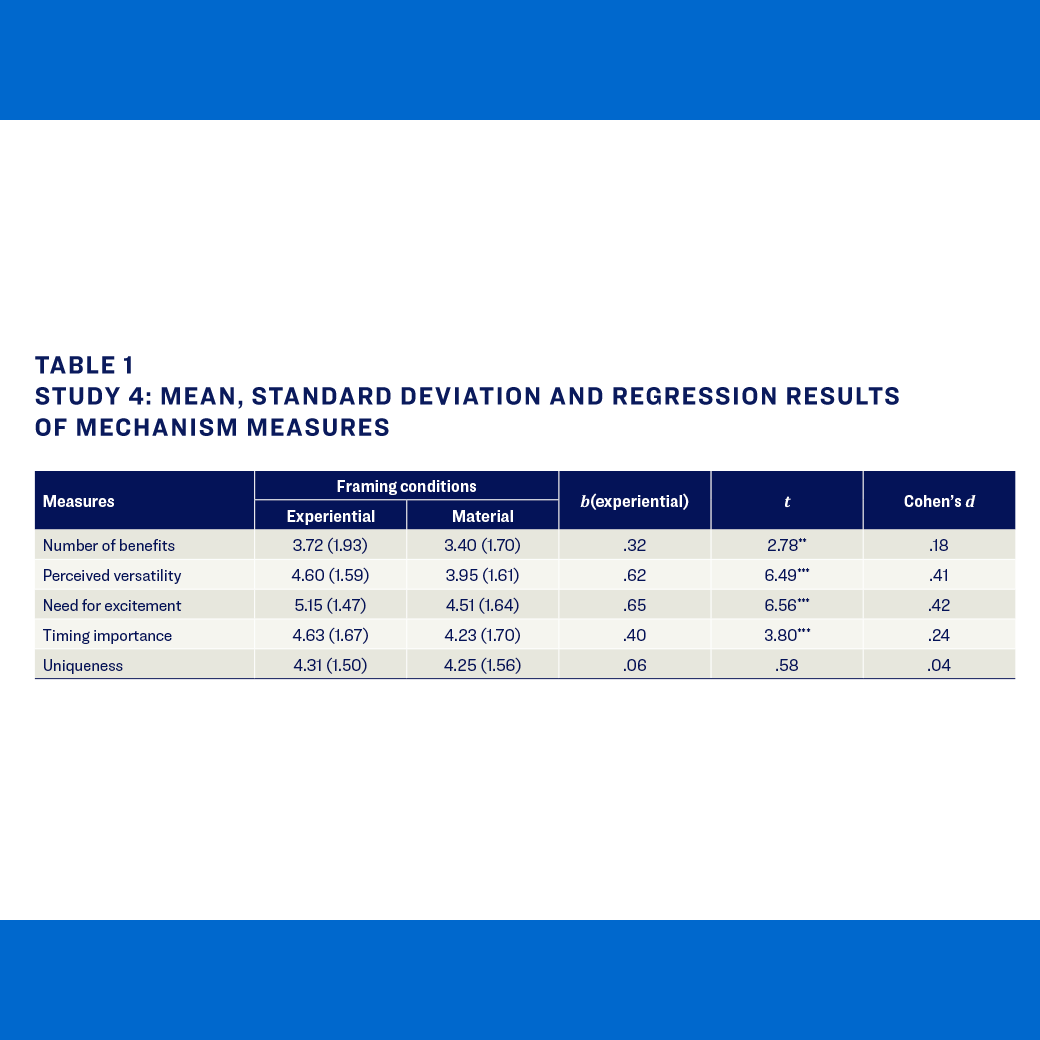

Because savings goals necessarily relate to future consumption, consumers face uncertainty about the degree to which a given savings goal target will be desirable at the time the goal is reached. As a result, goals that are seen as more versatile—satisfying a wider range of future preferences—are more likely to motivate savings than those that are less versatile. Building on this intuition, this study investigates how different types of savings goals motivate consumers to save.

Key Insights

- Consumers are more motivated to initiate, invest in and complete savings goals that are framed in terms of experiences as opposed to material goods.

- The motivational effect attenuates with very short goal-pursuit periods with less uncertainty involved and is stronger with long goal-pursuit periods.

- Framing saving for retirement as experiential (e.g., saving for life after retirement) rather than material (e.g., saving for housing, insurance and maintenance) may enhance goal versatility and increase consumers’ motivation to save for the future.