So called “white label funds” are generically named after a broad asset class and include one or more underlying funds. How prevalent is this labelling in defined contribution plans? How does their presence affect investment behavior?

Summary

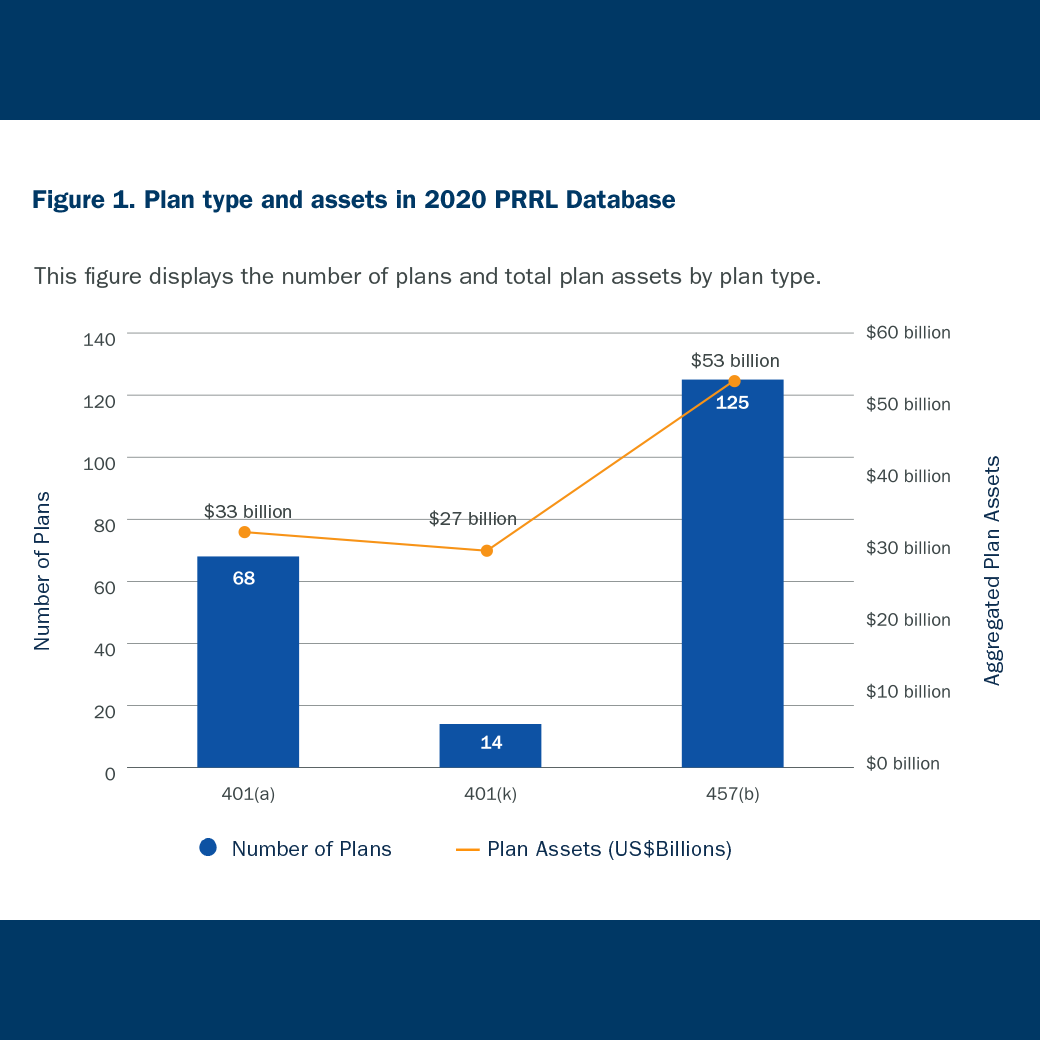

Using a new database of plan- and participant-level observations from public sector defined contribution retirement plans, the authors record the prevalence of white label funds in DC plan menus and compare the features of menus with and without these funds. At the participant level, they also conduct a preliminary analysis of how white labels affect investment allocations. Accordingly, the study’s results have important implications for fund providers and plan sponsors.

Key Insights

- White label funds are more prevalent in larger defined contribution plans, consistent with the hypothesis that implementation costs deter smaller plans.

- Two thirds of participant accounts are in plans that offer white label funds.

- White label plan menus feature either white label funds, white label funds including the employer’s name, or branded funds alongside white label options in a mixed menu.

- Compared to branded menus, white label and mixed menus generally offer fewer fund options and fund family choices but a similar selection of asset classes.

- Preliminary evidence suggests white label funds could slightly alter participants’ allocations towards discount brokerage windows.