Over half of higher ed employees are debt constrained and these individuals tend to be less confident in their retirement income prospects.

Summary

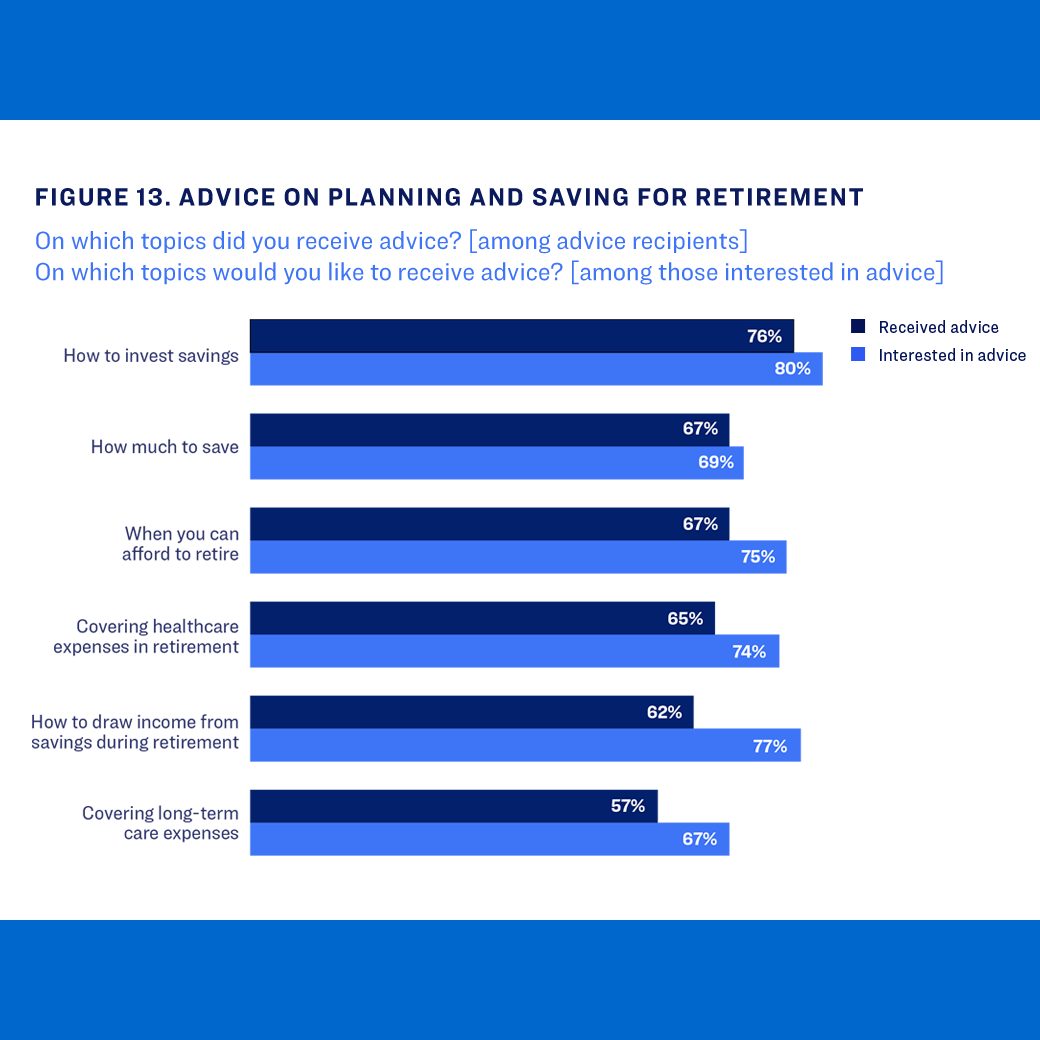

This report uses the TIAA Institute/CUPA-HR 2024 Higher Education Workforce Survey to examine financial well-being, including retirement readiness, among full-time college and university employees. The impact of debt, including student loan debt, receives particular attention. Retirement readiness depends on a series of decisions and actions—most fundamentally, the amount being saved, the investment allocation of savings, how to manage savings for income during retirement, and the use of advice throughout. Each is examined from the perspective of higher ed employees.

Key Insights

- The vast majority (80%) of higher ed employees carry debt and 72% of these are debt constrained. Borrowers with student loan debt are even more likely to be debt constrained (83%).

- One-third of those significantly debt constrained find it difficult to make ends meet, in contrast to only 4% of borrowers who are not debt constrained.

- While 93% of higher ed employees are saving for retirement, debt constraint still matters—20% of debt constrained savers aren’t confident they’re saving an adequate amount, compared with 4% of savers with no debt.

- One-quarter of retirement savers report they’ll definitely annuitize some of their savings in retirement. Paradoxically, annuitization can address the highest priorities of retirement savers who do not expect to annuitize.

- Advice promotes better retirement readiness. Forty percent of advice recipients are very confident they’ll have enough money to live comfortably throughout retirement, compared with 27% of savers who haven’t received advice. Among savers who reported following all the advice received: 64% are very confident in their retirement income prospects.